Page 14 - Allegacy 2019 Benefit Guide Full Time

P. 14

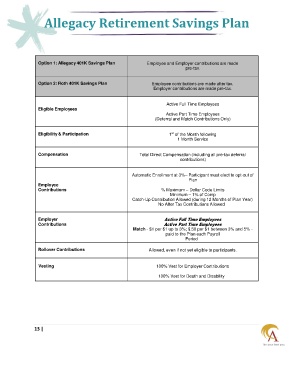

Allegacy Retirement Savings Plan

Option 1: Allegacy 401K Savings Plan Employee and Employer contributions are made

pre-tax.

Option 2: Roth 401K Savings Plan Employee contributions are made after tax.

Employer contributions are made pre-tax.

Active Full Time Employees

Eligible Employees

Active Part Time Employees

(Deferral and Match Contributions Only)

st

Eligibility & Participation 1 of the Month following

1 Month Service

Compensation Total Direct Compensation (including all pre-tax deferral

contributions)

Automatic Enrollment at 3%– Participant must elect to opt-out of

Plan

Employee

Contributions % Maximum – Dollar Code Limits

Minimum – 1% of Comp

Catch-Up Contribution Allowed (during 12 Months of Plan Year)

No After Tax Contributions Allowed

Employer Active Full Time Employees

Contributions Active Part Time Employees

Match - $1 per $1 up to 3%; $.50 per $1 between 3% and 5% -

paid to the Plan each Payroll

Period

Rollover Contributions Allowed, even if not yet eligible to participants.

Vesting 100% Vest for Employer Contributions

100% Vest for Death and Disability

13 |