Page 7 - Futr Investment Proposal

P. 7

7

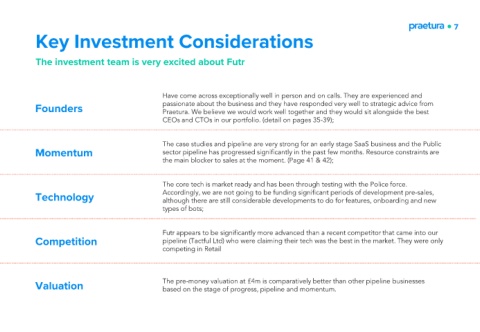

Key Investment Considerations

The investment team is very excited about Futr

Have come across exceptionally well in person and on calls. They are experienced and

Founders passionate about the business and they have responded very well to strategic advice from

Praetura. We believe we would work well together and they would sit alongside the best

CEOs and CTOs in our portfolio. (detail on pages 35-39);

The case studies and pipeline are very strong for an early stage SaaS business and the Public

Momentum sector pipeline has progressed significantly in the past few months. Resource constraints are

the main blocker to sales at the moment. (Page 41 & 42);

The core tech is market ready and has been through testing with the Police force.

Technology Accordingly, we are not going to be funding significant periods of development pre-sales,

although there are still considerable developments to do for features, onboarding and new

types of bots;

Futr appears to be significantly more advanced than a recent competitor that came into our

Competition pipeline (Tactful Ltd) who were claiming their tech was the best in the market. They were only

competing in Retail

Valuation The pre-money valuation at £4m is comparatively better than other pipeline businesses

based on the stage of progress, pipeline and momentum.