Page 37 - Employee Handbook - US

P. 37

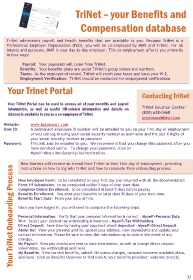

TriNet – your Benefits and

37

Compensation database

© MMR Research Worldwide. All rights

reserved.

TriNet administers payroll and health benefits that are available to you. Because TriNet is a

Professional Employer Organization (PEO), you will be co-employed by MMR and TriNet. For all

intents and purposes, MMR is your day-to-day employer. This co-employment affects you primarily

in four ways:

Payroll: Your payments will come from TriNet.

Benefits: Your benefits plans are under TriNet’s group names and numbers.

Taxes: As the employer of record, TriNet will remit your taxes and issue your W-2.

Employment Verification: TriNet should be contacted for employment verifications

Your Trinet Portal

Contacting TriNet

Your TriNet Portal can be used to access all of your benefits and payroll

information, as well as useful HR-related information and details on TriNet Solution Center:

discounts available to you as a co-employee of TriNet. (800) 638-0468

employees@trinet.com

Website: www.hrpassport.com

User ID: A permanent employee ID number will be emailed to you on your first day of employment

or you can log in using your social security number as username and the last 4 digits of

your social security number as password

Password: This will also be emailed to you. We recommend that you change this password after you

have enrolled online. To change your password, click on

Myself>About Me>Security/Authentication.

New Starters will receive an e-mail from TriNet in their first day of employment, providing

Your TriNet Onboarding Process

instructions on how to log into TriNet and how to complete their onboarding process.

New Employee Form: to be completed on your first day and returned with all the documentation

Form I-9 Submission: to be completed within 3 days of your start date.

Complete Online Enrollment: to be completed at least 5 days before payday

Benefits Enrollment: You must elect benefits no later than 30 days of your start date.

Benefits Start Date: From your date of hire.

Once you have logged in, you will need to complete the following steps:

Personal Information: Verify that your personal information is correct - Myself>Personal Data

W-4: Select your desired tax withholding allowances - Myself>Tax Withholding

Direct Deposit: Save time by having your paycheck direct deposited - Myself>Direct Deposit

About Me: View your personal profile, update your address, view dependents and update your

contact information. Please be sure to keep this information up to date in the event of any

changes.

My Payroll: View pay checks and year to date information, as well as change direct deposit

information, tax withholdings and more.

My Benefits: View current benefits, submit life status changes, compare between available plans,

and more. Click on Benefits Overview to find links to your benefits providers’ websites directly.

37