Page 412 - Bahrain Gov Annual Reports (I)_Neat

P. 412

-5-

410 m

raising revenue is quite understood*

It is however interestin': to remark that the only

comment on this change of duty came from a British fir

whose inports ere quite unimportant in value to the

State, and. even so, such imports are 1'or certain

’permitted* persons ’in*a commodity which is admitted

only bv o special concession by 11. i). the Ruler. The

comment resolved itself into the suggestion that imports

whose invoices were dated prior to the date of the

change in duty should be admitted at the prior existing

rates, accompanied with the curiously ingenuous state

ment that such was the custom accordin'* to ’interna

tional law’ !

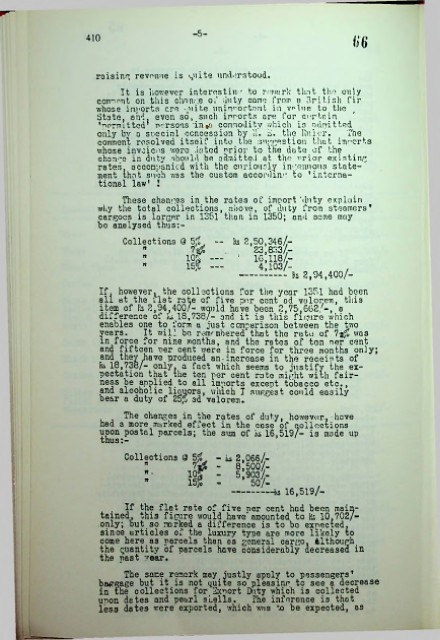

These changes in the rotes of import ’duty explain

why the total collections, above, of duty from steamers’

cargoes is larger in 1351 than in 1350; and same may

be analysed thus:-

Collections @ 5 — Rs 2,50,346/-

" 71& 23,833/-

" log — I 16,118/-

n 15? — 4,103/-

Rs 2,94,400/-

If. however^ the collectipns for the year 1351 had been

all at the list rate of five par cent od valorem, this

item of Rs 3,94,400/- would have been 2,75,662./-, a

difference of IU 18,738/— and it is this figure which

enables one to form a just comparison between the two

years. It v/i 12 be remembered that the rate of was

in force for nine months, and the rates of ten per cent

and £jTtcen -er cen^ '7ere in force for three months oniy;

and they have produced an-increase in the receipts of

Rs 18,738/- only, a fact which seems to justify the ex

pectation that the ten per cent rote might with fair

ness be applied to all imports except tobacco etc.,

and alcoholic liquors, which I suggest could easily

bear a duty of 25£ ad valorem.

The changes m the rates of duty, however., hove

had a more marked effect in the case of collocti ons

upon postal unreels; the sum of Ks 16,519/- is made up

thus:-

Collections (3 5£ - Ls 2,066/-

7j£ - 8 500/-

n .

lpr - 5,903/-

15? - 50/-

-Ks 16,519/-

. IT the flat rate of five per cent had been main

tained, this figure would have* amounted to Ks 10,702/-

only; out so marked a difference is to be expected,

since urticles of the luxury type are more likely to

come here as parcels than as general cargo. Although#

the quantity of parcels have considerably decreased in

the nast year#

The sane remark may justly apnly to passengers’

baggage but it is not quite so pleasing to see a decrease

in the collections for Sxuort Duty which is collected

unon dates and pearl shells. The inference is that

less dates were exported, which ms to be expected, as