Page 27 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 27

*

24

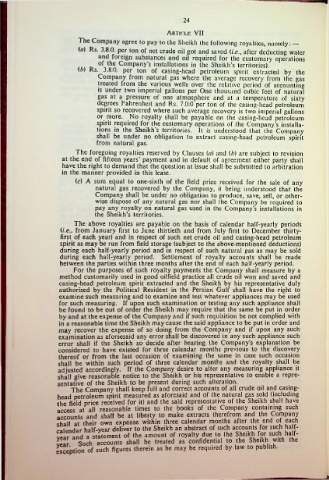

Article VII

The Company agree to pay to the Sheikh the following royalties, namely: —

(a) Rs. 3.8.0. per ton of net crude oil got and saved (/.<?., after deducting water

and foreign substances and oil required for the customary operations

°* ^*ie Company’s installations in the Sheikh’s territories).

\b) Rs. 3.8.0. per ton of casing-head petroleum spirit extracted by the

Company from natural gas where the average recovery from the gas

treated from the various wells over the relative period of accounting

is under two imperial gallons per One thousand cubic feet of natural

gas at a pressure of one atmosphere and at a temperature of sixty

degrees Fahrenheit and Rs. 7.0.0 per ton of the casing-head petroleum

spirit so recovered where such average recovery is two imperial gallons

or more. No royalty shall be payable on the casing-head petroleum

spirit required for the customary operations of the Company’s installa

tions in the Sheikh’s territories. It is understood that the Company

shall be under no obligation to extract casing-head petroleum spirit

from natural gas.

The foregoing royalties reserved by Clauses (a) and (b) are subject to revision

at the end of fifteen years’ payment and in default of agreement either party shall

have the right to demand that the question at issue shall be submitted to arbitration

in the manner provided in this lease.

(c) A sum equal to one-sixth of the field price received for the sale of any

natural gas recovered by the Company, it being understood that the

Company shall be under no obligation to produce, save, sell, or other

wise dispose of any natural gas nor shall the Company be required to

pay any royalty on natural gas used in the Company’s installations in

the Sheikh’s territories.

The above royalties are payable on the basis of calendar half-yearly periods

(i.e., from January first to June thirtieth and from July first to December thirty-

first of each year) and in respect of such net crude oil and casing-head petroleum

spirit as may be run from field storage (subject to the above-mentioned deductions)

during each half-yearly period and in respect of such natural gas as may be sold

during each half-yearly period. Settlement of royalty accounts shall be made

between the parties within three months after the end of each half-yearly period.

For the purposes of such royalty payments the Company shall measure by a

method customarily used in good oilfield practice all crude oil won and saved and

casing-head petroleum spirit extracted and the Sheikh by his representative duly

authorised by the Political Resident in the Persian Gulf shall have the right to

examine such measuring and to examine and test whatever appliances may be used

for such measuring. If upon such examination or testing any such appliance shall

be found to be out of order the Sheikh may require that the same be put in order

by and at the expense of the Company and if such requisition be not complied with

in a reasonable time the Sheikh may cause the said appliance to be put in order and

may recover the expense of so doing from the Company and if upon any such

examination as aforsesaid any error shall be discovered in any such appliance such

error shall if the Sheikh so decide after hearing the Company’s explanation be

considered to have existed for three calendar months previous to the discovery

thereof or from the last occasion of examining the same in case such occasion

shall be within such period of three calendar months and the royalty shall be

adjusted accordingly. If the Company desire to alter any measuring appliance it

shall give reasonable notice to the Sheikh or his representative to enable a repre

sentative of the Sheikh to be present during such alteration.

The Company shall keep full and correct accounts of all crude oil and casing

head petroleum spirit measured as aforesaid and of the natural gas sold (including

the field price received for it) and the said representative of the Sheikh shall have

access at all reasonable times to the books of the Company containing such

accounts and shall be at liberty to make extracts therefrom and the Company

shall at their own expense within three calendar months after the end of each

calendar half-year deliver to the Sheikh an abstract of such accounts for such ha f-

vear and a statement of the amount of royalty due to the Sheikh for such ha I f-

vear Such accounts shall be treated as confidential to the Sheikh with the

exception of such figures therein as he may be required by law to publish.