Page 9 - CSJ - ADF - AMB 10 07 19

P. 9

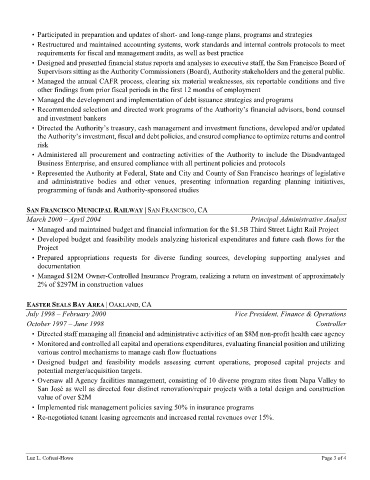

• Participated in preparation and updates of short- and long-range plans, programs and strategies

• Restructured and maintained accounting systems, work standards and internal controls protocols to meet

requirements for fiscal and management audits, as well as best practice

• Designed and presented financial status reports and analyses to executive staff, the San Francisco Board of

Supervisors sitting as the Authority Commissioners (Board), Authority stakeholders and the general public.

• Managed the annual CAFR process, clearing six material weaknesses, six reportable conditions and five

other findings from prior fiscal periods in the first 12 months of employment

• Managed the development and implementation of debt issuance strategies and programs

• Recommended selection and directed work programs of the Authority’s financial advisors, bond counsel

and investment bankers

• Directed the Authority’s treasury, cash management and investment functions, developed and/or updated

the Authority’s investment, fiscal and debt policies, and ensured compliance to optimize returns and control

risk

• Administered all procurement and contracting activities of the Authority to include the Disadvantaged

Business Enterprise, and ensured compliance with all pertinent policies and protocols

• Represented the Authority at Federal, State and City and County of San Francisco hearings of legislative

and administrative bodies and other venues, presenting information regarding planning initiatives,

programming of funds and Authority-sponsored studies

SAN FRANCISCO MUNICIPAL RAILWAY | SAN FRANCISCO, CA

March 2000 – April 2004 Principal Administrative Analyst

• Managed and maintained budget and financial information for the $1.5B Third Street Light Rail Project

• Developed budget and feasibility models analyzing historical expenditures and future cash flows for the

Project

• Prepared appropriations requests for diverse funding sources, developing supporting analyses and

documentation

• Managed $12M Owner-Controlled Insurance Program, realizing a return on investment of approximately

2% of $297M in construction values

EASTER SEALS BAY AREA | OAKLAND, CA

July 1998 – February 2000 Vice President, Finance & Operations

October 1997 – June 1998 Controller

• Directed staff managing all financial and administrative activities of an $8M non-profit health care agency

• Monitored and controlled all capital and operations expenditures, evaluating financial position and utilizing

various control mechanisms to manage cash flow fluctuations

• Designed budget and feasibility models assessing current operations, proposed capital projects and

potential merger/acquisition targets.

• Oversaw all Agency facilities management, consisting of 10 diverse program sites from Napa Valley to

San José as well as directed four distinct renovation/repair projects with a total design and construction

value of over $2M

• Implemented risk management policies saving 50% in insurance programs

• Re-negotiated tenant leasing agreements and increased rental revenues over 15%.

Luz L. Cofresí-Howe Page 3 of 4