Page 418 - Aida Hovsepian Onboarding

P. 418

2/28/2018 CSCS Record Retention and Disposition Schedule

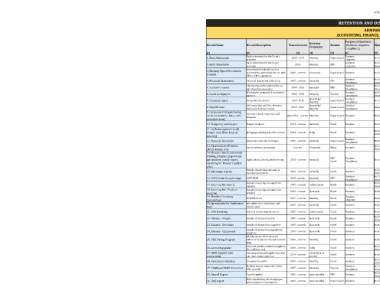

RETENTION AND DISPOSITION SCHEDULE

ADMINISTRATION:

ACCOUNTING, FINANCE, AND HUMAN RESOURCES

Purpose of Existence Minimum Maximum Business Process # Business

Record Name Record Description Years Covered Revision Format (Business, Litigation, Main Location Duplicate Retention Period Retention Period Disposition (CSCS Risk Control Process Further

Frequency Locations Method Comments

Compliance) (in years) (in years) Matrix) Description

[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14]

1. Bank Statements Bank statements for the Co-op's 2009 - 2015 Monthly Paper-based Business In Cindy's office None 7 7 Destroy securely BP 80 Bank Account Archive old

accounts Litigation Management documents

Bank statements for the Co-p's Business In Cindy's personal Bank Account Based on IRS

2. Bank Statements accounts 2016 Monthly PDF Litigation drive None 7 7 Destroy securely BP 80 Management Guidelines

3. Banking Signed Documents Documents from banks such as Bank Account Based on IRS

(copies) account info, authorizations, etc. with 2009 - current As needed Paper-based Business In Cindy's office Bank 7 7 Destroy securely BP 80 Management Guidelines

CEO or CFO's signatures

Business In Cindy's personal Finance & Based on IRS

4. Financial Statements Financial statements of the Co-p 2009 - current Annually PDF Compliance drive Crowe-Horwath Permanently Permanently None BP 50 - BP 60 Accounting Guidelines

Third-party audit results of the Co- Business In Cindy's personal Finance & Based on IRS

5. Auditor's reports 2009 - 2015 Annually PDF Crowe-Horwath Permanently Permanently None BP 50 - BP 60

op's financial statements Compliance drive Accounting Guidelines

6. Audit workpapers Workpapers prepared & provided to 2009 - 2015 Annually Various Business In Cindy's personal Crowe-Horwath 7 7 Destroy securely BP 50 - BP 60 Finance & Based on IRS

auditors Compliance drive Accounting Guidelines

Quarterly/ Business Finance & Based on IRS

7. Corporate taxes Corporate tax returns 2009- 2015 Monthly Paper-based Compliance In Cindy's office Crowe-Horwath 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

8. Payroll taxes IRS Forms-940 and 941; Missouri, 2009 - 2015 Quarterly/ Paper-based Business Infosync None 7 7 Destroy securely BP 50 - BP 60 Finance & Based on IRS

California, Arizona returns Monthly Compliance Accounting Guidelines

9. Corporate VISA purchasing Commerce

cards (statements, fees, cards, Commerce Bank corporate card June 2011 - current Monthly Paper-based Business In Cindy's office Bank's online 7 7 Destroy securely BP 50 - BP 60 Finance & Back-up expenses

Accounting

program

administration) website

10. Budgeting workpapers Budget template 2011 - current Annually Excel Business In Cindy's office None 3 3 Destroy securely BP 50 - BP 60 Finance & Missouri Standards

Accounting

11. Cash management (cash

budget, cash flows from all Managing cash deposit, cash sources 2011 - current Daily Excel Business In Cindy's personal Infosync 3 3 Destroy securely BP 50 - BP 60 Finance & 5 different

drive

spreadsheets

Accounting

sources)

Business In Cindy's & Finance &

12. Business Insurance Corporate costs and coverages 2009 - current Annually Paper-based IMA Corporation 3 3 Destroy securely BP 50 - BP 60 Missouri Standards

Compliance Dustin's offices Accounting

13. Passwords to Websites In Cindy's personal In Dustin's Finance &

(401K, banks, etc.) List of websites' passwords Current As needed Word Business drive personal drive None None None BP 50 - BP 60 Accounting

14. Missouri work customized

training program (paperwork, PDF Business State of Finance & Based on IRS

spreadsheet, yearly report, Applications, awards, and invoicing 2011 - current Annually Excel Compliance In Cindy's office Missouri's 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

reporting for Missouri quality database

jobs)

Details of patronage amounts to In Cindy's personal Finance & Based on Federal

15. Patronage reports members and stores 2009 - current Annually Excel Business drive None 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

Business In Cindy's personal Based on Federal

16. 1099 forms for patronage 1099 PATR 2009 -current Annually PDF Crowe-Horwath 7 7 Destroy securely

Compliance drive Guidelines

Details of sourcing amounts from In Cindy's personal Vendors' Finance & Based on Federal

17. Sourcing fee reports 2009 - current Continuously Excel Business 7 7 Destroy securely BP 50 - BP 60

vendors drive database Accounting Guidelines

18. Sourcing fee - Produce Details of sourcing amounts from 2013 - current Quarterly Excel Business In the shared drive Danaco 7 7 Destroy securely BP 50 - BP 60 Finance & Based on Federal

program vendors Accounting Guidelines

19. Member Financing HCWF Roll-out 2015 - current Monthly Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60 Finance & Based on Federal

Spreadsheet Litigation Accounting Guidelines

20. Spreadsheet for Conference Spreadsheet for attendance and 2009 - current Annually Excel Business In the shared drive 7 7 Destroy securely BP 50 - BP 60 Finance & Based on Federal

Fees money owed Accounting Guidelines

Finance & Based on Federal

21. PVA Invoicing Invoices to distribution centers 2009 - current Continuously Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

In Cindy's personal Logistics Finance & Based on Federal

22. Rebates - Freight Details of rebates from DCs 2009 - current Quarterly Excel Business 7 7 Destroy securely BP 50 - BP 60

drive (Kristen's file) Accounting Guidelines

Finance & Based on Federal

23. Rebates - Revenues Details of rebates from suppliers 2009 - current Quarterly Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60

Accounting Guidelines

Details of rebates from equipment Finance & Based on Federal

24. Rebates - Equipment suppliers 2009 - current Quarterly Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

CSCS Invoices/ DC invoices for

25. PEG Pricing Program difference between PEG and contract 2009 - current Monthly Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60 Finance & Based on Federal

Accounting

Guidelines

FOB

Amounts owed to vendors (suppliers, In Cindy's personal Finance & Based on Federal

26. Accounts payable DCs, utilities, etc.) 2009 - current Daily Excel Business drive Infosync 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

27. HAVI supplier and Invoicing of annual supplier fees and Annually & as- Finance & Based on Federal

connectivity one-time connectivity fees 2014 - current needed Excel Business In the shared drive None 7 7 Destroy securely BP 50 - BP 60 Accounting Guidelines

In Cindy's personal Finance & Based on Federal

28. Restaurant visitation Company's benefits 2009 - current Monthly Excel Business Susie's file 7 7 Destroy securely BP 50 - BP 60

drive Accounting Guidelines

Medical, dental, vision, life/ ADND, Business In Cindy's personal BCBS & Human Based on IRS

29. Employee Health Insurance 2009 - current Annually Various 7 7 Destroy securely BP 70 - BP 75

STD, and LTD Compliance drive Standard Resources Guidelines

In Cindy's personal Human Based on IRS

30. Payroll Report Payroll register 2009 - current Semi-monthly PDF Business drive Infosync 7 7 Destroy securely BP 70 - BP 75 Resources Guidelines

2

31. HAS report HAS contribution, list of employee 2009 - current Semi-monthly Paper-based Business In Cindy's office UMB Bank 7 7 Destroy securely BP 70 - BP 75 Human Based on IRS

and employer's contributions Resources Guidelines