Page 350 - Onboarding May 2017

P. 350

Confidential and Privileged

For the Audit and Finance Committee's Review

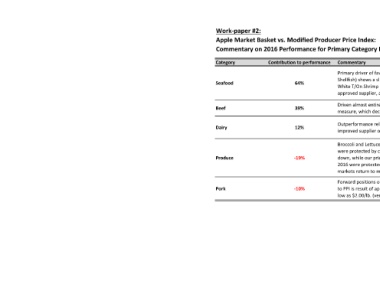

Work-paper #2:

Apple Market Basket vs. Modified Producer Price Index:

Commentary on 2016 Performance for Primary Category Drivers

Category Contribution to performance Commentary

Primary driver of favorable variance is 41/50 Shrimp. While PPI measure (Prepared Frozen

Shellfish) shows a slight increase, a closer market indicator is the UB 41/50 Farm Raised Asian

Seafood 64%

White T/On Shrimp - which decreased by 12.8%, versus our pricing that decreased by 17%. Newly

approved supplier, as well as spot buying strategy helped us in a down market.

Driven almost entirely by Fresh Ground Chuck, which decreased by nearly 20% YOY, versus PPI

Beef 39%

measure, which decreased by 3.7%.

Outperformance relative to PPI was driven primarily by markets lags on Asiago and Parm cheeses,

Dairy 12%

improved supplier overages on Mozzarella Sticks, and optimizing of supplier ship-to's on cheeses.

Broccoli and Lettuce markets were both strong in 2015 due to weather/crop issues. CSCS prices

were protected by caps and remained relatively steady. 2016's softer markets drove the PPI

Produce -19% down, while our prices remained relatively steady. In the case of Tomatoes, strong markets in

2016 were protected by CSCS driving a favorability for 2016. This will likely reverse in 2017 if

markets return to more normal levels.

Forward positions on Bellies in 2016 were unfavorable to market for FY by 4%. Primary variance

Pork -10% to PPI is result of application of "bank" dollars to Bacon Bit pricing in 2015 that created pricing as

low as $2.00/lb. (versus 2016 market-based price averaging $5.08/lb.).