Page 14 - Kavka Proposal Web

P. 14

Part Two

Investment

Opportunity

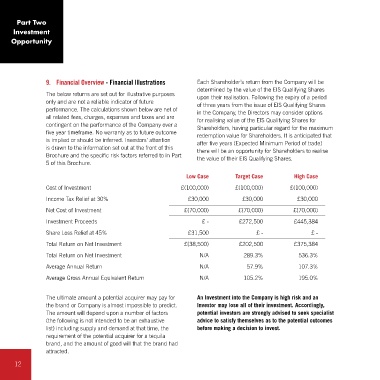

9. Financial Overview - Financial Illustrations Each Shareholder’s return from the Company will be

determined by the value of the EIS Qualifying Shares

The below returns are set out for illustrative purposes upon their realisation. Following the expiry of a period

only and are not a reliable indicator of future of three years from the issue of EIS Qualifying Shares

performance. The calculations shown below are net of in the Company, the Directors may consider options

all related fees, charges, expenses and taxes and are for realising value of the EIS Qualifying Shares for

contingent on the performance of the Company over a Shareholders, having particular regard for the maximum

five year timeframe. No warranty as to future outcome redemption value for Shareholders. It is anticipated that

is implied or should be inferred. Investors’ attention after five years (Expected Minimum Period of trade)

is drawn to the information set out at the front of this there will be an opportunity for Shareholders to realise

Brochure and the specific risk factors referred to in Part the value of their EIS Qualifying Shares.

5 of this Brochure.

Low Case Target Case High Case

Cost of Investment £(100,000) £(100,000) £(100,000)

Income Tax Relief at 30% £30,000 £30,000 £30,000

Net Cost of Investment £(70,000) £(70,000) £(70,000)

Investment Proceeds £ - £272,500 £445,384

Share Loss Relief at 45% £31,500 £ - £ -

Total Return on Net Investment £(38,500) £202,500 £375,384

Total Return on Net Investment N/A 289.3% 536.3%

Average Annual Return N/A 57.9% 107.3%

Average Gross Annual Equivalent Return N/A 105.2% 195.0%

The ultimate amount a potential acquirer may pay for An Investment into the Company is high risk and an

the brand or Company is almost impossible to predict. Investor may lose all of their investment. Accordingly,

The amount will depend upon a number of factors potential investors are strongly advised to seek specialist

(the following is not intended to be an exhaustive advice to satisfy themselves as to the potential outcomes

list) including supply and demand at that time, the before making a decision to invest.

requirement of the potential acquirer for a tequila

brand, and the amount of good will that the brand had

attracted.

12