Page 54 - SE Outlook Regions 2023

P. 54

2.6.3 Inflation and monetary policy

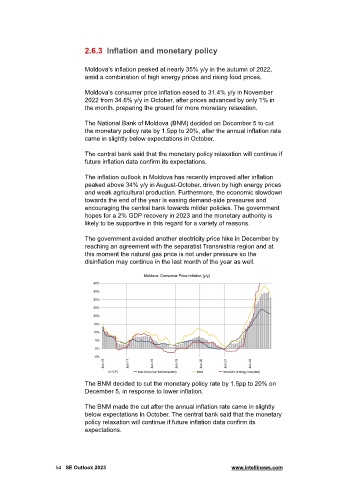

Moldova’s inflation peaked at nearly 35% y/y in the autumn of 2022,

amid a combination of high energy prices and rising food prices.

Moldova’s consumer price inflation eased to 31.4% y/y in November

2022 from 34.6% y/y in October, after prices advanced by only 1% in

the month, preparing the ground for more monetary relaxation.

The National Bank of Moldova (BNM) decided on December 5 to cut

the monetary policy rate by 1.5pp to 20%, after the annual inflation rate

came in slightly below expectations in October.

The central bank said that the monetary policy relaxation will continue if

future inflation data confirm its expectations.

The inflation outlook in Moldova has recently improved after inflation

peaked above 34% y/y in August-October, driven by high energy prices

and weak agricultural production. Furthermore, the economic slowdown

towards the end of the year is easing demand-side pressures and

encouraging the central bank towards milder policies. The government

hopes for a 2% GDP recovery in 2023 and the monetary authority is

likely to be supportive in this regard for a variety of reasons.

The government avoided another electricity price hike in December by

reaching an agreement with the separatist Transnistria region and at

this moment the natural gas price is not under pressure so the

disinflation may continue in the last month of the year as well.

The BNM decided to cut the monetary policy rate by 1.5pp to 20% on

December 5, in response to lower inflation.

The BNM made the cut after the annual inflation rate came in slightly

below expectations in October. The central bank said that the monetary

policy relaxation will continue if future inflation data confirm its

expectations.

54 SE Outlook 2023 www.intellinews.com