Page 55 - SE Outlook Regions 2023

P. 55

At the same time, the BNM decided to cut by 3pp the required reserve

ratios for the local currency liabilities (to 37%) and foreign currency

liabilities (to 34%).

2.6.4 Industrial production

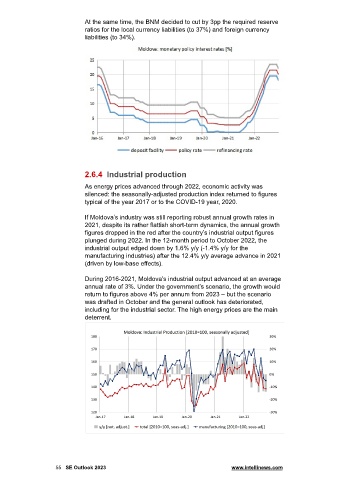

As energy prices advanced through 2022, economic activity was

silenced: the seasonally-adjusted production index returned to figures

typical of the year 2017 or to the COVID-19 year, 2020.

If Moldova’s industry was still reporting robust annual growth rates in

2021, despite its rather flattish short-term dynamics, the annual growth

figures dropped in the red after the country’s industrial output figures

plunged during 2022. In the 12-month period to October 2022, the

industrial output edged down by 1.6% y/y (-1.4% y/y for the

manufacturing industries) after the 12.4% y/y average advance in 2021

(driven by low-base effects).

During 2016-2021, Moldova’s industrial output advanced at an average

annual rate of 3%. Under the government’s scenario, the growth would

return to figures above 4% per annum from 2023 – but the scenario

was drafted in October and the general outlook has deteriorated,

including for the industrial sector. The high energy prices are the main

deterrent.

55 SE Outlook 2023 www.intellinews.com