Page 51 - SE Outlook Regions 2023

P. 51

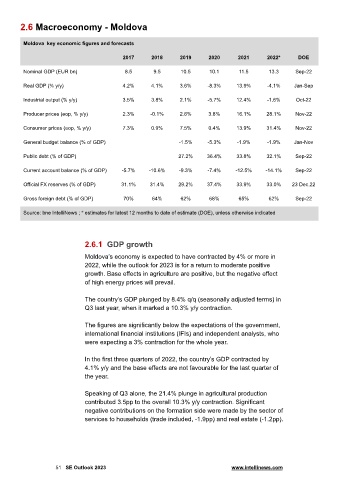

2.6 Macroeconomy - Moldova

Moldova key economic figures and forecasts

2017 2018 2019 2020 2021 2022* DOE

Nominal GDP (EUR bn) 8.5 9.5 10.5 10.1 11.5 13.3 Sep-22

Real GDP (% y/y) 4.2% 4.1% 3.6% -8.3% 13.9% -4.1% Jan-Sep

Industrial output (% y/y) 3.5% 3.8% 2.1% -5.7% 12.4% -1.6% Oct-22

Producer prices (eop, % y/y) 2.3% -0.1% 2.6% 3.8% 16.1% 28.1% Nov-22

Consumer prices (eop, % y/y) 7.3% 0.9% 7.5% 0.4% 13.9% 31.4% Nov-22

General budget balance (% of GDP) -1.5% -5.3% -1.9% -1.9% Jan-Nov

Public debt (% of GDP) 27.2% 36.4% 33.8% 32.1% Sep-22

Current account balance (% of GDP) -5.7% -10.6% -9.3% -7.4% -12.5% -14.1% Sep-22

Official FX reserves (% of GDP) 31.1% 31.4% 29.2% 37.4% 33.9% 33.0% 23 Dec.22

Gross foreign debt (% of GDP) 70% 64% 62% 68% 65% 62% Sep-22

Source: bne IntelliNews ; * estimates for latest 12 months to date of estimate (DOE), unless otherwise indicated

2.6.1 GDP growth

Moldova’s economy is expected to have contracted by 4% or more in

2022, while the outlook for 2023 is for a return to moderate positive

growth. Base effects in agriculture are positive, but the negative effect

of high energy prices will prevail.

The country’s GDP plunged by 8.4% q/q (seasonally adjusted terms) in

Q3 last year, when it marked a 10.3% y/y contraction.

The figures are significantly below the expectations of the government,

international financial institutions (IFIs) and independent analysts, who

were expecting a 3% contraction for the whole year.

In the first three quarters of 2022, the country’s GDP contracted by

4.1% y/y and the base effects are not favourable for the last quarter of

the year.

Speaking of Q3 alone, the 21.4% plunge in agricultural production

contributed 3.5pp to the overall 10.3% y/y contraction. Significant

negative contributions on the formation side were made by the sector of

services to households (trade included, -1.9pp) and real estate (-1.2pp).

51 SE Outlook 2023 www.intellinews.com