Page 9 - MEOG Week 39

P. 9

MEOG PERFORMANCE MEOG

IOCs receive payments from KRG

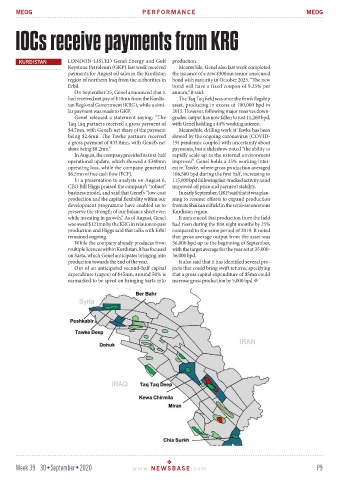

KURDISTAN LONDON-LISTED Genel Energy and Gulf production.

Keystone Petroleum (GKP) last week received Meanwhile, Genel also last week completed

payments for August oil sales in the Kurdistan the issuance of a new $300mn senior unsecured

region of northern Iraq from the authorities in bond with maturity in October 2025. “The new

Erbil. bond will have a fixed coupon of 9.25% per

On September 25, Genel announced that it annum,” it said.

had received net pay of $10mn from the Kurdis- The Taq Taq field was once the firm’s flagship

tan Regional Government (KRG), while a simi- asset, producing in excess of 100,000 bpd in

lar payment was made to GKP. 2015. However, following major reserves down-

Genel released a statement saying: “The grades, output has now fallen to just 11,260 bpd,

Taq Taq partners received a gross payment of with Genel holding a 44% working interest.

$4.7mn, with Genel’s net share of the payment Meanwhile, drilling work at Tawke has been

being $2.6mn. The Tawke partners received slowed by the ongoing coronavirus (COVID-

a gross payment of $33.8mn, with Genel’s net 19) pandemic coupled with uncertainty about

share being $8.2mn.” payments, but a slideshow noted “the ability to

In August, the company provided its first-half rapidly scale up as the external environment

operational update, which showed a $340mn improves”. Genel holds a 25% working inter-

operating loss, while the company generated est in Tawke, where gross production averaged

$6.5mn of free cash flow (FCF). 108,580 bpd during the first half, increasing to

In a presentation to analysts on August 6, 115,000 bpd following fast-tracked activity amid

CEO Bill Higgs praised the company’s “robust” improved oil price and payment stability.

business model, and said that Genel’s “low-cost In early September, GKP said that it was plan-

production and the capital flexibility within our ning to resume efforts to expand production

development programme have enabled us to from its Shaikan oilfield in the semi-autonomous

preserve the strength of our balance sheet even Kurdistan region.

while investing in growth.” As of August, Genel It announced that production from the field

was owed $121mn by the KRG in relation to past had risen during the first eight months by 25%

production and Higgs said that talks with Erbil compared to the same period of 2019. It noted

remained ongoing. that gross average output from the asset was

While the company already produces from 36,000 bpd up to the beginning of September,

multiple licences within Kurdistan, it has focused with the target average for the year set at 35,000-

on Sarta, which Genel anticipates bringing into 36,000 bpd.

production towards the end of the year. It also said that it has identified several pro-

Out of an anticipated second-half capital jects that could bring swift returns, specifying

expenditure (capex) of $45mn, around 50% is that a gross capital expenditure of $5mn could

earmarked to be spent on bringing Sarta into increase gross production by 5,000 bpd.

Week 39 30•September•2020 www. NEWSBASE .com P9