Page 146 - NobleCon19revC2_Neat

P. 146

Industrials

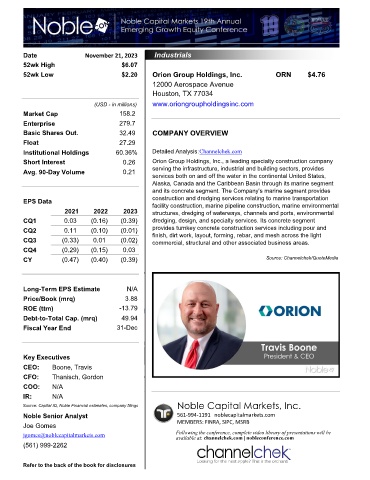

Date November 21, 2023 Industrials

52wk High $6.07

52wk Low $2.20 Orion Group Holdings, Inc. ORN $4.76

12000 Aerospace Avenue

Houston, TX 77034

(USD - in millions) www.oriongroupholdingsinc.com

Market Cap 158.2

Enterprise 279.7

Basic Shares Out. 32.49 COMPANY OVERVIEW

Float 27.29

Institutional Holdings 60.36% Detailed Analysis:Channelchek.com

Short Interest 0.26 Orion Group Holdings, Inc., a leading specialty construction company

Avg. 90-Day Volume 0.21 serving the infrastructure, industrial and building sectors, provides

services both on and off the water in the continental United States,

Alaska, Canada and the Caribbean Basin through its marine segment

and its concrete segment. The Company’s marine segment provides

EPS Data construction and dredging services relating to marine transportation

facility construction, marine pipeline construction, marine environmental

2021 2022 2023 structures, dredging of waterways, channels and ports, environmental

CQ1 0.03 (0.16) (0.39) dredging, design, and specialty services. Its concrete segment

CQ2 0.11 (0.10) (0.01) provides turnkey concrete construction services including pour and

finish, dirt work, layout, forming, rebar, and mesh across the light

CQ3 (0.33) 0.01 (0.02) commercial, structural and other associated business areas.

CQ4 (0.29) (0.15) 0.03

CY (0.47) (0.40) (0.39) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 3.88

ROE (ttm) -13.79

Debt-to-Total Cap. (mrq) 49.94

Fiscal Year End 31-Dec

12000 Aerosp Houston TX 77034

Key Executives

CEO: Boone, Travis

CFO: Thanisch, Gordon

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Joe Gomes MEMBERS: FINRA, SIPC, MSRB

jgomes@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2262

Refer to the back of the book for disclosures