Page 4 - 2015 Best Practices of Spectacle Lens Management

P. 4

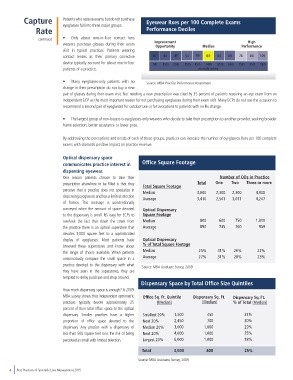

Capture Patients who receive exams but do not purchase Eyewear Rxes per 100 Complete Exams

Rate eyeglasses fall into three major groups: Performance Deciles

continued • Only about one-in-four contact lens Improvement High

wearers purchase glasses during their exam Opportunity Median Performance

visit in typical practices. Patients wearing

contact lenses as their primary corrective 30 44 49 54 59 61 64 68 76 88 109

device typically account for about one-in-four 5th 15th 25th 35th 45th 50th 55th 65th 75th 85th 95th

patients of a practice. percentile ranking

• Many eyeglasses-only patients with no Source: MBA Practice Performance Assessment

change in their prescription do not buy a new

pair of glasses during their exam visit. Not needing a new prescription was cited by 35 percent of patients receiving an eye exam from an

independent ECP as the most important reason for not purchasing eyeglasses during their exam visit. Many ECPs do not use the occasion to

recommend a second pair of eyeglasses for outdoor use or for avocations to patients with no Rx change.

• The largest group of non-buyers is eyeglasses-only wearers who decide to take their prescription to another provider, seeking broader

frame selection, better assistance or lower price.

By addressing the perceptions and needs of each of these groups, practices can increase the number of eyeglasses Rxes per 100 complete

exams with dramatic positive impact on practice revenue.

Optical dispensary space

communicates practice interest in Office Square Footage

dispensing eyewear.

One reason patients choose to take their Number of ODs in Practice

prescription elsewhere to be filled is that they Total Square Footage Total One Two Three or more

perceive that a practice does not specialize in Median 3,000 2,300 2,300 4,000

dispensing eyeglasses and has a limited selection Average 3,410 2,541 3,011 4,247

of frames. This message is unintentionally

conveyed when the amount of space devoted Optical Dispensary

to the dispensary is small. It’s easy for ECPs to Square Footage

overlook the fact that down the street from Median 800 600 750 1,000

the practice there is an optical superstore that Average 890 735 760 959

devotes 3,000 square feet to a sophisticated

display of eyeglasses. Most patients have Optical Dispensary

browsed these superstores and know about % of Total Square Footage

the range of choice available. When patients Median 25% 31% 26% 22%

unconsciously compare the small space in a Average 27% 31% 28% 23%

practice devoted to the dispensary with what

Source: MBA Graduate Survey, 2009

they have seen in the superstores, they are

tempted to delay purchase and shop around.

Dispensary Space by Total Office Size Quintiles

How much dispensary space is enough? A 2009

MBA survey shows that independent optometric Office Sq. Ft. Quintile Dispensary Sq. Ft. Dispensary Sq. Ft.

practices typically devote approximately 25 (Median) (Median) % of Total (Median)

percent of their total office space to the optical

dispensary. Smaller practices have a higher Smallest 20% 1,500 450 31%

proportion of office space devoted to the Next 20% 2,450 700 30%

dispensary. Any practice with a dispensary of Median 20% 3,000 1,000 29%

less than 500 square feet runs the risk of being Next 20% 4,000 1,000 25%

perceived as small with limited selection. Largest 20% 6,000 1,000 18%

Total 3,000 800 25%

Source: MBA Graduate Survey, 2009

4 Best Practices of Spectacle Lens Management 2015