Page 22 - July 2018 inLeague with Conference Program

P. 22

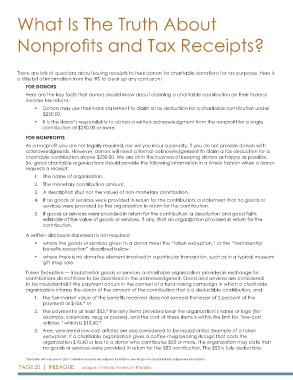

What Is The Truth About

Nonprofits and Tax Receipts?

There are lots of questions about issuing receipts to their donors for charitable donations for tax purposes. Here is

a little bit of information from the IRS to clear up any confusion!

FOR DONORS

Here are the key facts that donors should know about claiming a charitable contribution on their federal

income tax returns:

• Donors may use their bank statement to claim a tax deduction for a charitable contribution under

$250.00.

• It is the donor’s responsibility to obtain a written acknowledgment from the nonprofit for a single

contribution of $250.00 or more.

FOR NONPROFITS

As a nonprofit you are not legally required, nor will you incur a penalty, if you do not provide donors with

acknowledgments. However, donors will need a formal acknowledgement to claim a tax deduction for a

charitable contribution above $250.00. We are all in the business of keeping donors as happy as possible.

So, good charitable organizations should provide the following information in a timely fashion when a donor

requests a receipt:

1. The name of organization.

2. The monetary contribution amount.

3. A description (but not the value) of non-monetary contribution.

4. If no goods or services were provided in return for the contribution: a statement that no goods or

services were provided by the organization in return for the contribution.

5. If goods or services were provided in return for the contribution: a description and good faith

estimate of the value of goods or services, if any, that an organization provided in return for the

contribution.

A written disclosure statement is not required:

• where the goods or services given to a donor meet the “token exception,” or the “membership

benefits exception” described below.

• where there is no donative element involved in a particular transaction, such as in a typical museum

gift shop sale

Token Exception — Insubstantial goods or services a charitable organization provides in exchange for

contributions do not have to be described in the acknowledgment. Good and services are considered

to be insubstantial if the payment occurs in the context of a fund-raising campaign in which a charitable

organization informs the donor of the amount of the contribution that is a deductible contribution, and:

1. the fair market value of the benefits received does not exceed the lesser of 2 percent of the

payment or $106,* or

2. the payment is at least $53,* the only items provided bear the organization’s name or logo (for

example, calendars, mug or posters), and the cost of these items is within the limit for “low-cost

articles,” which is $10.60.*

3. Free, unordered low-cost articles are also considered to be insubstantial. Example of a token

exception: If a charitable organization gives a coffee mug bearing its logo that costs the

organization $10.60 or less to a donor who contributes $53 or more, the organization may state that

no goods or services were provided in return for the $53 contribution. The $53 is fully deductible.

*The dollar amounts are for 2016. Guideline amounts are adjusted for inflation. See IRS.gov for annual inflation adjustment information.

PAGE 20 | INLEAGUE League of Historic American Theatres