Page 1646 - draft

P. 1646

U.S. PUBLIC FINANCE

Implied Debt Service

A school district’s implied debt service represents the annual cost to amortize its long-term debt over 20

years with level payments. We use a 20-year amortization period to reflect the typical composite useful life

of capital assets financed by school districts, which range from assets with long expected useful lives, such

as school buildings, to assets with short useful lives, such as school buses and technology improvements.

The 20-year amortization period also provides a general composite of the weighted average maturity of a

school district’s debt outstanding.

We use a school district’s implied debt service rather than its actual debt service as an input to the fixed-

costs ratio for two key reasons. First, implied debt service provides a comparable measure of annual debt

carrying costs across school districts. Using actual debt service in the ratio could have the effect of

rewarding the backloading of debt amortization — in these cases, the current year ratio would understate

the school district’s growing fixed cost burden. Using actual debt service could also penalize more rapid debt

amortization, because the current fixed-costs ratio would appear relatively weak. Second, implied debt

service avoids potentially misleading volatility in actual debt service payments that can be caused by

refunding (i.e., debt refinancing) activity.

We calculate or estimate implied debt service in several steps (see the exhibit below):

» Step 1: We assign a common implied interest rate to all school districts, approximately annually. We

base the implied interest rate each year upon a 10-year rolling average of a high-grade municipal bond

index, such as the Bond Buyer 20-bond GO index or a comparable index, as of the end of the prior

calendar year. (see line A).

» Step 2: A level-dollar amortization divisor is calculated, using a 20-year period and the implied interest

rate calculated in Step 1 (see line B).

» Step 3: The school district’s debt outstanding at the beginning of the fiscal year (i.e., its outstanding

debt at the end of the prior year) is divided by the amortization divisor calculated in Step 2. The result is

the implied debt service (see lines C and D).

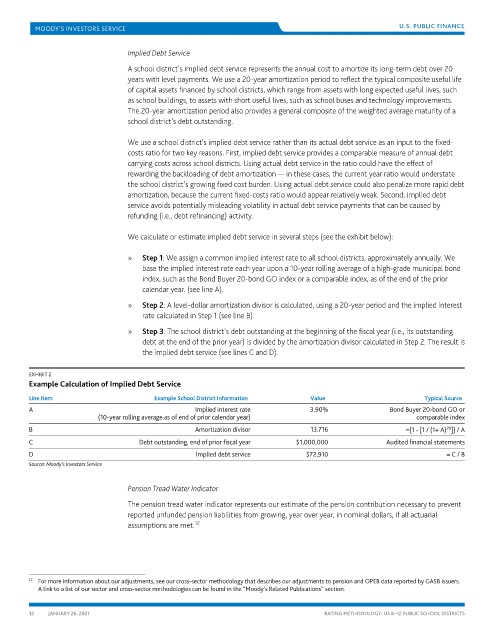

EXHIBIT 2

Example Calculation of Implied Debt Service

Line item Example School District Information Value Typical Source

A Implied interest rate 3.90% Bond Buyer 20-bond GO or

(10-year rolling average as of end of prior calendar year) comparable index

20

B Amortization divisor 13.716 ={1 - [1 / (1+ A) ]} / A

C Debt outstanding, end of prior fiscal year $1,000,000 Audited financial statements

D Implied debt service $72,910 = C / B

Source: Moody’s Investors Service

Pension Tread Water Indicator

The pension tread water indicator represents our estimate of the pension contribution necessary to prevent

reported unfunded pension liabilities from growing, year over year, in nominal dollars, if all actuarial

12

assumptions are met.

12 For more information about our adjustments, see our cross-sector methodology that describes our adjustments to pension and OPEB data reported by GASB issuers.

A link to a list of our sector and cross-sector methodologies can be found in the “Moody’s Related Publications” section.

12 JANUARY 26, 2021 RATING METHODOLOGY: US K–12 PUBLIC SCHOOL DISTRICTS