Page 1644 - draft

P. 1644

U.S. PUBLIC FINANCE

FACTOR

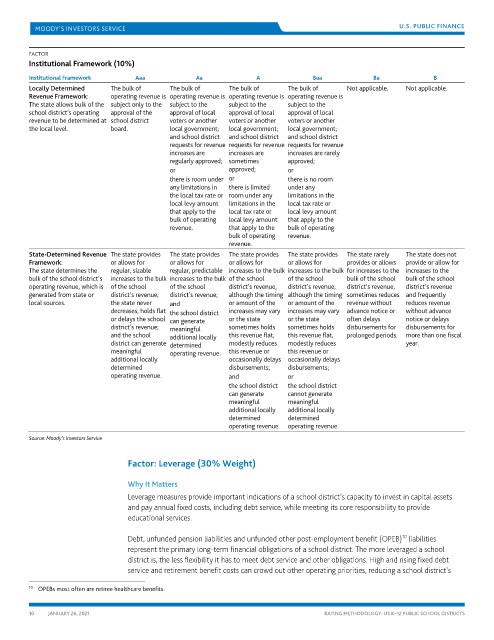

Institutional Framework (10%)

Institutional Framework Aaa Aa A Baa Ba B

Locally Determined The bulk of The bulk of The bulk of The bulk of Not applicable. Not applicable.

Revenue Framework: operating revenue is operating revenue is operating revenue is operating revenue is

The state allows bulk of the subject only to the subject to the subject to the subject to the

school district’s operating approval of the approval of local approval of local approval of local

revenue to be determined at school district voters or another voters or another voters or another

the local level. board. local government; local government; local government;

and school district and school district and school district

requests for revenue requests for revenue requests for revenue

increases are increases are increases are rarely

regularly approved; sometimes approved;

or approved; or

there is room under or there is no room

any limitations in there is limited under any

the local tax rate or room under any limitations in the

local levy amount limitations in the local tax rate or

that apply to the local tax rate or local levy amount

bulk of operating local levy amount that apply to the

revenue. that apply to the bulk of operating

bulk of operating revenue.

revenue.

State-Determined Revenue The state provides The state provides The state provides The state provides The state rarely The state does not

Framework: or allows for or allows for or allows for or allows for provides or allows provide or allow for

The state determines the regular, sizable regular, predictable increases to the bulk increases to the bulk for increases to the increases to the

bulk of the school district’s increases to the bulk increases to the bulk of the school of the school bulk of the school bulk of the school

operating revenue, which is of the school of the school district’s revenue, district’s revenue, district’s revenue, district’s revenue

generated from state or district’s revenue; district’s revenue; although the timing although the timing sometimes reduces and frequently

local sources. the state never and or amount of the or amount of the revenue without reduces revenue

decreases, holds flat the school district increases may vary increases may vary advance notice or without advance

or delays the school can generate or the state or the state often delays notice or delays

district’s revenue; meaningful sometimes holds sometimes holds disbursements for disbursements for

and the school additional locally this revenue flat, this revenue flat, prolonged periods. more than one fiscal

district can generate determined modestly reduces modestly reduces year.

meaningful operating revenue. this revenue or this revenue or

additional locally occasionally delays occasionally delays

determined disbursements; disbursements;

operating revenue. and or

the school district the school district

can generate cannot generate

meaningful meaningful

additional locally additional locally

determined determined

operating revenue. operating revenue.

Source: Moody’s Investors Service

Factor: Leverage (30% Weight)

Why It Matters

Leverage measures provide important indications of a school district’s capacity to invest in capital assets

and pay annual fixed costs, including debt service, while meeting its core responsibility to provide

educational services.

10

Debt, unfunded pension liabilities and unfunded other post-employment benefit (OPEB) liabilities

represent the primary long-term financial obligations of a school district. The more leveraged a school

district is, the less flexibility it has to meet debt service and other obligations. High and rising fixed debt

service and retirement benefit costs can crowd out other operating priorities, reducing a school district’s

10 OPEBs most often are retiree healthcare benefits.

10 JANUARY 26, 2021 RATING METHODOLOGY: US K–12 PUBLIC SCHOOL DISTRICTS