Page 283 - IOM Law Society Rules Book

P. 283

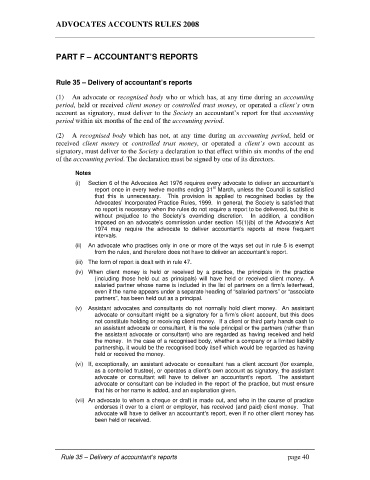

ADVOCATES ACCOUNTS RULES 2008

PART F – ACCOUNTANT’S REPORTS

Rule 35 – Delivery of accountant’s reports

(1) An advocate or recognised body who or which has, at any time during an accounting

period, held or received client money or controlled trust money, or operated a client’s own

account as signatory, must deliver to the Society an accountant’s report for that accounting

period within six months of the end of the accounting period.

(2) A recognised body which has not, at any time during an accounting period, held or

received client money or controlled trust money, or operated a client’s own account as

signatory, must deliver to the Society a declaration to that effect within six months of the end

of the accounting period. The declaration must be signed by one of its directors.

Notes

(i) Section 6 of the Advocates Act 1976 requires every advocate to deliver an accountant’s

st

report once in every twelve months ending 31 March, unless the Council is satisfied

that this is unnecessary. This provision is applied to recognised bodies by the

Advocates’ Incorporated Practice Rules, 1999. In general, the Society is satisfied that

no report is necessary when the rules do not require a report to be delivered, but this is

without prejudice to the Society’s overriding discretion. In addition, a condition

imposed on an advocate’s commission under section 15(1)(b) of the Advocate’s Act

1974 may require the advocate to deliver accountant’s reports at more frequent

intervals.

(ii) An advocate who practises only in one or more of the ways set out in rule 5 is exempt

from the rules, and therefore does not have to deliver an accountant’s report.

(iii) The form of report is dealt with in rule 47.

(iv) When client money is held or received by a practice, the principals in the practice

(including those held out as principals) will have held or received client money. A

salaried partner whose name is included in the list of partners on a firm’s letterhead,

even if the name appears under a separate heading of “salaried partners” or “associate

partners”, has been held out as a principal.

(v) Assistant advocates and consultants do not normally hold client money. An assistant

advocate or consultant might be a signatory for a firm’s client account, but this does

not constitute holding or receiving client money. If a client or third party hands cash to

an assistant advocate or consultant, it is the sole principal or the partners (rather than

the assistant advocate or consultant) who are regarded as having received and held

the money. In the case of a recognised body, whether a company or a limited liability

partnership, it would be the recognised body itself which would be regarded as having

held or received the money.

(vi) If, exceptionally, an assistant advocate or consultant has a client account (for example,

as a controlled trustee), or operates a client’s own account as signatory, the assistant

advocate or consultant will have to deliver an accountant’s report. The assistant

advocate or consultant can be included in the report of the practice, but must ensure

that his or her name is added, and an explanation given.

(vii) An advocate to whom a cheque or draft is made out, and who in the course of practice

endorses it over to a client or employer, has received (and paid) client money. That

advocate will have to deliver an accountant’s report, even if no other client money has

been held or received.

Rule 35 – Delivery of accountant’s reports page 40