Page 20 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 20

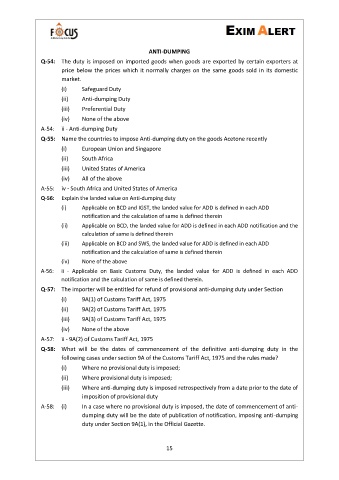

ANTI-DUMPING

Q-54: The duty is imposed on imported goods when goods are exported by certain exporters at

price below the prices which it normally charges on the same goods sold in its domestic

market.

(i) Safeguard Duty

(ii) Anti-dumping Duty

(iii) Preferential Duty

(iv) None of the above

A-54: ii - Anti-dumping Duty

Q-55: Name the countries to impose Anti-dumping duty on the goods Acetone recently

(i) European Union and Singapore

(ii) South Africa

(iii) United States of America

(iv) All of the above

A-55: iv - South Africa and United States of America

Q-56: Explain the landed value on Anti-dumping duty

(i) Applicable on BCD and IGST, the landed value for ADD is defined in each ADD

notification and the calculation of same is defined therein

(ii) Applicable on BCD, the landed value for ADD is defined in each ADD notification and the

calculation of same is defined therein

(iii) Applicable on BCD and SWS, the landed value for ADD is defined in each ADD

notification and the calculation of same is defined therein

(iv) None of the above

A-56: ii - Applicable on Basic Customs Duty, the landed value for ADD is defined in each ADD

notification and the calculation of same is defined therein.

Q-57: The importer will be entitled for refund of provisional anti-dumping duty under Section

(i) 9A(1) of Customs Tariff Act, 1975

(ii) 9A(2) of Customs Tariff Act, 1975

(iii) 9A(3) of Customs Tariff Act, 1975

(iv) None of the above

A-57: ii - 9A(2) of Customs Tariff Act, 1975

Q-58: What will be the dates of commencement of the definitive anti-dumping duty in the

following cases under section 9A of the Customs Tariff Act, 1975 and the rules made?

(i) Where no provisional duty is imposed;

(ii) Where provisional duty is imposed;

(iii) Where anti-dumping duty is imposed retrospectively from a date prior to the date of

imposition of provisional duty

A-58: (i) In a case where no provisional duty is imposed, the date of commencement of anti-

dumping duty will be the date of publication of notification, imposing anti-dumping

duty under Section 9A(1), in the Official Gazette.

15