Page 23 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 23

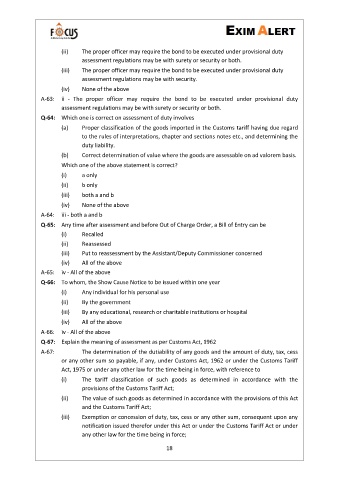

(ii) The proper officer may require the bond to be executed under provisional duty

assessment regulations may be with surety or security or both.

(iii) The proper officer may require the bond to be executed under provisional duty

assessment regulations may be with security.

(iv) None of the above

A-63: ii - The proper officer may require the bond to be executed under provisional duty

assessment regulations may be with surety or security or both.

Q-64: Which one is correct on assessment of duty involves

(a) Proper classification of the goods imported in the Customs tariff having due regard

to the rules of interpretations, chapter and sections notes etc., and determining the

duty liability.

(b) Correct determination of value where the goods are assessable on ad valorem basis.

Which one of the above statement is correct?

(i) a only

(ii) b only

(iii) both a and b

(iv) None of the above

A-64: iii - both a and b

Q-65: Any time after assessment and before Out of Charge Order, a Bill of Entry can be

(i) Recalled

(ii) Reassessed

(iii) Put to reassessment by the Assistant/Deputy Commissioner concerned

(iv) All of the above

A-65: iv - All of the above

Q-66: To whom, the Show Cause Notice to be issued within one year

(i) Any individual for his personal use

(ii) By the government

(iii) By any educational, research or charitable institutions or hospital

(iv) All of the above

A-66: iv - All of the above

Q-67: Explain the meaning of assessment as per Customs Act, 1962

A-67: The determination of the dutiability of any goods and the amount of duty, tax, cess

or any other sum so payable, if any, under Customs Act, 1962 or under the Customs Tariff

Act, 1975 or under any other law for the time being in force, with reference to

(i) The tariff classification of such goods as determined in accordance with the

provisions of the Customs Tariff Act;

(ii) The value of such goods as determined in accordance with the provisions of this Act

and the Customs Tariff Act;

(iii) Exemption or concession of duty, tax, cess or any other sum, consequent upon any

notification issued therefor under this Act or under the Customs Tariff Act or under

any other law for the time being in force;

18