Page 24 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 24

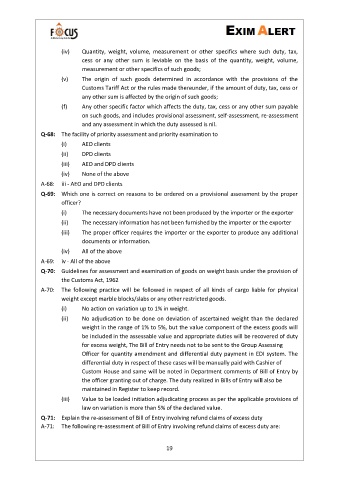

(iv) Quantity, weight, volume, measurement or other specifics where such duty, tax,

cess or any other sum is leviable on the basis of the quantity, weight, volume,

measurement or other specifics of such goods;

(v) The origin of such goods determined in accordance with the provisions of the

Customs Tariff Act or the rules made thereunder, if the amount of duty, tax, cess or

any other sum is affected by the origin of such goods;

(f) Any other specific factor which affects the duty, tax, cess or any other sum payable

on such goods, and includes provisional assessment, self-assessment, re-assessment

and any assessment in which the duty assessed is nil.

Q-68: The facility of priority assessment and priority examination to

(i) AEO clients

(ii) DPD clients

(iii) AEO and DPD clients

(iv) None of the above

A-68: iii - AEO and DPD clients

Q-69: Which one is correct on reasons to be ordered on a provisional assessment by the proper

officer?

(i) The necessary documents have not been produced by the importer or the exporter

(ii) The necessary information has not been furnished by the importer or the exporter

(iii) The proper officer requires the importer or the exporter to produce any additional

documents or information.

(iv) All of the above

A-69: iv - All of the above

Q-70: Guidelines for assessment and examination of goods on weight basis under the provision of

the Customs Act, 1962

A-70: The following practice will be followed in respect of all kinds of cargo liable for physical

weight except marble blocks/slabs or any other restricted goods.

(i) No action on variation up to 1% in weight.

(ii) No adjudication to be done on deviation of ascertained weight than the declared

weight in the range of 1% to 5%, but the value component of the excess goods will

be included in the assessable value and appropriate duties will be recovered of duty

for excess weight, The Bill of Entry needs not to be sent to the Group Assessing

Officer for quantity amendment and differential duty payment in EDI system. The

differential duty in respect of these cases will be manually paid with Cashier of

Custom House and same will be noted in Department comments of Bill of Entry by

the officer granting out of charge. The duty realized in Bills of Entry will also be

maintained in Register to keep record.

(iii) Value to be loaded initiation adjudicating process as per the applicable provisions of

law on variation is more than 5% of the declared value.

Q-71: Explain the re-assessment of Bill of Entry involving refund claims of excess duty

A-71: The following re-assessment of Bill of Entry involving refund claims of excess duty are:

19