Page 245 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 245

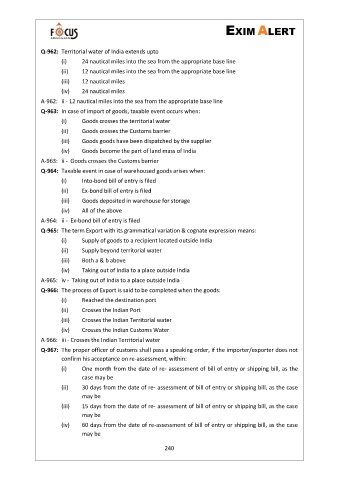

Q-962: Territorial water of India extends upto

(i) 24 nautical miles into the sea from the appropriate base line

(ii) 12 nautical miles into the sea from the appropriate base line

(iii) 12 nautical miles

(iv) 24 nautical miles

A-962: ii - 12 nautical miles into the sea from the appropriate base line

Q-963: In case of import of goods, taxable event occurs when:

(i) Goods crosses the territorial water

(ii) Goods crosses the Customs barrier

(iii) Goods goods have been dispatched by the supplier

(iv) Goods become the part of land mass of India

A-963: ii - Goods crosses the Customs barrier

Q-964: Taxable event in case of warehoused goods arises when:

(i) Into-bond bill of entry is filed

(ii) Ex-bond bill of entry is filed

(iii) Goods deposited in warehouse for storage

(iv) All of the above

A-964: ii - Ex-bond bill of entry is filed

Q-965: The term Export with its grammatical variation & cognate expression means:

(i) Supply of goods to a recipient located outside India

(ii) Supply beyond territorial water

(iii) Both a & b above

(iv) Taking out of India to a place outside India

A-965: iv - Taking out of India to a place outside India

Q-966: The process of Export is said to be completed when the goods:

(i) Reached the destination port

(ii) Crosses the Indian Port

(iii) Crosses the Indian Territorial water

(iv) Crosses the Indian Customs Water

A-966: iii - Crosses the Indian Territorial water

Q-967: The proper officer of customs shall pass a speaking order, if the importer/exporter does not

confirm his acceptance on re-assessment, within:

(i) One month from the date of re- assessment of bill of entry or shipping bill, as the

case may be

(ii) 30 days from the date of re- assessment of bill of entry or shipping bill, as the case

may be

(iii) 15 days from the date of re- assessment of bill of entry or shipping bill, as the case

may be

(iv) 60 days from the date of re-assessment of bill of entry or shipping bill, as the case

may be

240