Page 244 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 244

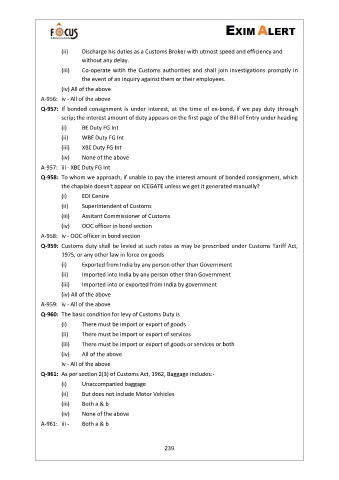

(ii) Discharge his duties as a Customs Broker with utmost speed and efficiency and

without any delay.

(iii) Co-operate witih the Customs authorities and shall join investigations promptly in

the event of an inquiry against them or their employees.

(iv) All of the above

A-956: iv - All of the above

Q-957: If bonded consignment is under interest, at the time of ex-bond, if we pay duty through

scrip; the interest amount of duty appears on the first page of the Bill of Entry under heading

(i) BE Duty FG Int

(ii) WBE Duty FG Int

(iii) XBE Duty FG Int

(iv) None of the above

A-957: iii - XBE Duty FG Int

Q-958: To whom we approach, if unable to pay the interest amount of bonded consignment, which

the chaplain doesn't appear on ICEGATE unless we get it generated manually?

(i) EDI Centre

(ii) Superintendent of Customs

(iii) Assitant Commissioner of Customs

(iv) OOC officer in bond section

A-958: iv - OOC officer in bond section

Q-959: Customs duty shall be levied at such rates as may be prescribed under Customs Tariff Act,

1975, or any other law in force on goods

(i) Exported from India by any person other than Government

(ii) Imported into India by any person other than Government

(iii) Imported into or exported from India by government

(iv) All of the above

A-959: iv - All of the above

Q-960: The basic condition for levy of Customs Duty is

(i) There must be import or export of goods

(ii) There must be import or export of services

(iii) There must be import or export of goods or services or both

(iv) All of the above

iv - All of the above

Q-961: As per section 2(3) of Customs Act, 1962, Baggage includes:-

(i) Unaccompanied baggage

(ii) But does not include Motor Vehicles

(iii) Both a & b

(iv) None of the above

A-961: iii - Both a & b

239