Page 243 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 243

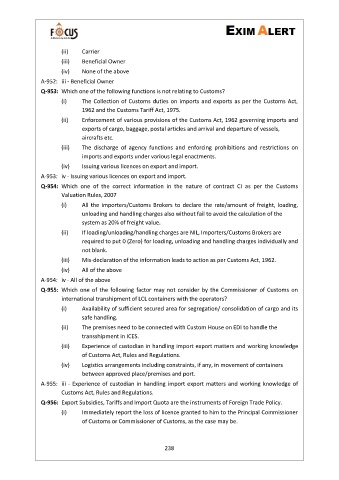

(ii) Carrier

(iii) Beneficial Owner

(iv) None of the above

A-952: iii - Beneficial Owner

Q-953: Which one of the following functions is not relating to Customs?

(i) The Collection of Customs duties on imports and exports as per the Customs Act,

1962 and the Customs Tariff Act, 1975.

(ii) Enforcement of various provisions of the Customs Act, 1962 governing imports and

exports of cargo, baggage, postal articles and arrival and departure of vessels,

aircrafts etc.

(iii) The discharge of agency functions and enforcing prohibitions and restrictions on

imports and exports under various legal enactments.

(iv) Issuing various licences on export and import.

A-953: iv - Issuing various licences on export and import.

Q-954: Which one of the correct information in the nature of contract CI as per the Customs

Valuation Rules, 2007

(i) All the importers/Customs Brokers to declare the rate/amount of freight, loading,

unloading and handling charges also without fail to avoid the calculation of the

system as 20% of freight value.

(ii) If loading/unloading/handling charges are NIL, Importers/Customs Brokers are

required to put 0 (Zero) for loading, unloading and handling charges individually and

not blank.

(iii) Mis-declaration of the information leads to action as per Customs Act, 1962.

(iv) All of the above

A-954: iv - All of the above

Q-955: Which one of the following factor may not consider by the Commissioner of Customs on

international transhipment of LCL containers with the operators?

(i) Availability of sufficient secured area for segregation/ consolidation of cargo and its

safe handling.

(ii) The premises need to be connected with Custom House on EDI to handle the

transshipment in ICES.

(iii) Experience of custodian in handling import export matters and working knowledge

of Customs Act, Rules and Regulations.

(iv) Logistics arrangements including constraints, if any, in movement of containers

between approved place/premises and port.

A-955: iii - Experience of custodian in handling import export matters and working knowledge of

Customs Act, Rules and Regulations.

Q-956: Export Subsidies, Tariffs and Import Quota are the instruments of Foreign Trade Policy.

(i) Immediately report the loss of licence granted to him to the Principal Commissioner

of Customs or Commissioner of Customs, as the case may be.

238