Page 247 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 247

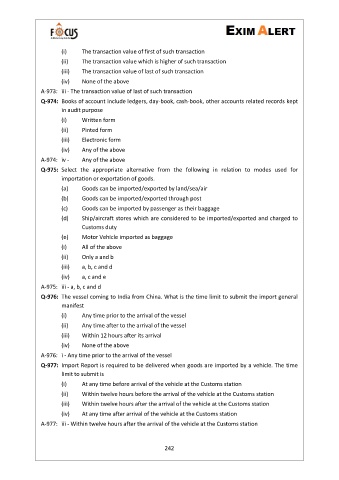

(i) The transaction value of first of such transaction

(ii) The transaction value which is higher of such transaction

(iii) The transaction value of last of such transaction

(iv) None of the above

A-973: iii - The transaction value of last of such transaction

Q-974: Books of account include ledgers, day-book, cash-book, other accounts related records kept

in audit purpose

(i) Written form

(ii) Pinted form

(iii) Electronic form

(iv) Any of the above

A-974: iv - Any of the above

Q-975: Select the appropriate alternative from the following in relation to modes used for

importation or exportation of goods.

(a) Goods can be imported/exported by land/sea/air

(b) Goods can be imported/exported through post

(c) Goods can be imported by passenger as their baggage

(d) Ship/aircraft stores which are considered to be imported/exported and charged to

Customs duty

(e) Motor Vehicle imported as baggage

(i) All of the above

(ii) Only a and b

(iii) a, b, c and d

(iv) a, c and e

A-975: iii - a, b, c and d

Q-976: The vessel coming to India from China. What is the time limit to submit the import general

manifest

(i) Any time prior to the arrival of the vessel

(ii) Any time after to the arrival of the vessel

(iii) Within 12 hours after its arrival

(iv) None of the above

A-976: i - Any time prior to the arrival of the vessel

Q-977: Import Report is required to be delivered when goods are imported by a vehicle. The time

limit to submit is

(i) At any time before arrival of the vehicle at the Customs station

(ii) Within twelve hours before the arrival of the vehicle at the Customs station

(iii) Within twelve hours after the arrival of the vehicle at the Customs station

(iv) At any time after arrival of the vehicle at the Customs station

A-977: iii - Within twelve hours after the arrival of the vehicle at the Customs station

242