Page 29 - The Economist

P. 29

United States The Economist December 9th 2017 29

Also in this section

30 Public lands and Uncle Sam

30 Alabama’s special election

31 Child brides

32 Still promoting Democracy

35 Lexington: Chaos and conspiracy

For daily analysis and debate on America, visit

Economist.com/unitedstates

Economist.com/blogs/democracyinamerica

Tax reform in context Centre for American Progress, a left-lean-

What a difference three decades makes ing think-tank, the tax system as a whole

reduced the GINI index, a measure of in-

equality, by5% before the reform, butby 7%

afterit.

Today’s bill is sharply regressive, de-

spite the fact that it barely touches the top

rate of tax. That is partly because Mr

WASHINGTON, DC Trump’s priority has been taxcuts for busi-

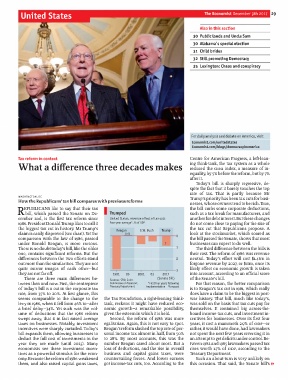

Howthe Republicans’ taxbill compares with previous reforms

nesses, whose ownerstend to be rich. True,

EPUBLICANS like to say that their tax the bill curbs some corporate deductions,

Rbill, which passed the Senate on De- Trumped such as a tax break for manufacturers, and

cember 2nd, is the first tax reform since United States, revenue effect of tax cuts anotherfordebtinterest. Butthese changes

1986. PresidentDonald Trump likesto call it Four-year average*, % of GDP do not come close to paying for the size of

the biggest tax cut in history. Mr Trump’s Reagan G.W. Bush Trump the tax cut that Republicans propose. A

claim iseasilydisproved (see chart). Yetthe 0.01 0 look at the stockmarket, which soared as

comparison with the law of 1986, passed – the bill passed the Senate, shows that most

under Ronald Reagan, is more curious. † businesses can expect to do well.

There isno doubttoday’sbill, like the older 1 The third difference between the bills is

one, contains significant reforms. But the their cost. The reform of1986 was revenue

differences between the two efforts stand 2 neutral. Today’s effort will cost $1.4trn in

outmore than the similarities. Theyare not forgone revenue by 2027, or $1trn, once its

quite mirror images of each other—but 3 likely effect on economic growth is taken

they are not faroff. 1981 86 2001 03 2017 into account, according to an official score

There are three main differences be- Sources: CBO; Joint (Senate bill) ofthe Senate’s bill.

tween then and now. First, the centrepiece Committee on Taxation; *First four years following For that reason, the better comparison

†

of today’s bill is a cut in the corporate tax Treasury Department implementation Forecast is to Reagan’s tax cut in 1981, which really

rate, from 35% to 20%. At first glance, this does have a claim to be the biggest in post-

seems comparable to the change to the the Tax Foundation, a right-leaning think- war history. That bill, much like today’s,

levy in 1986, when it fell from 46% to—after tank, reckons it might have reduced eco- was sold on the basis that tax cuts pay for

a brief delay—34%. Yet such was the vol- nomic growth—a remarkable possibility, themselves. It contained big across-the-

ume of deductions that the 1986 reform given the esteem in which it is held. board income-tax cuts, and investment in-

swept away, that it in fact raised average Second, the reform of 1986 was more centives for businesses. Over its first four

taxes on businesses. Notably, investment egalitarian. Again, this is not easy to spot. years, it cost a mammoth 2.9% of GDP—or

incentives were sharply curtailed. Today’s Reagan’sreform slashed the top rate of per- rather, it would have done, had lawmakers

bill expands them, allowing businesses to sonal income tax almost in half, from 50% not spent the next few years reversing it in

deduct the full cost of investments in the to 28%. By most accounts, this was the an attempt to get deficits under control. Be-

year they are made (until 2023). Many number Reagan cared about most. But a tween 1982 and 1985 lawmakers passed tax

economists see these investment incen- loss of deductions, and the rise in overall rises worth 1.7% of GDP, according to the

tives as a powerful stimulus for the econ- business and capital gains taxes, were Treasury Department.

omy. Because the reform of1986 weakened countervailing forces. And lower earners Such an about-turn is very unlikely on

them, and also raised capital gains taxes, got income-tax cuts, too. According to the this occasion. That said, the Senate bill’s 1