Page 120 - VIRANSH COACHING CLASSES

P. 120

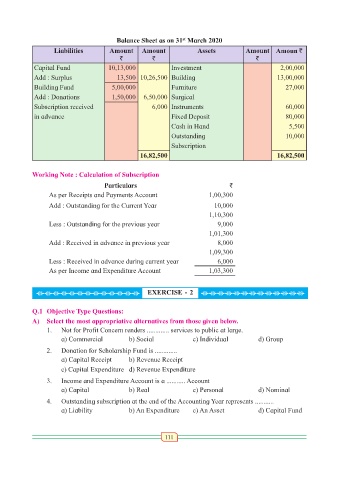

Balance Sheet as on 31 March 2020

st

Liabilities Amount Amount Assets Amount Amoun `

` ` `

Capital Fund 10,13,000 Investment 2,00,000

Add : Surplus 13,500 10,26,500 Building 13,00,000

Building Fund 5,00,000 Furniture 27,000

Add : Donations 1,50,000 6,50,000 Surgical

Subscription received 6,000 Instruments 60,000

in advance Fixed Deposit 80,000

Cash in Hand 5,500

Outstanding 10,000

Subscription

16,82,500 16,82,500

Working Note : Calculation of Subscription

Particulars `

As per Receipts and Payments Account 1,00,300

Add : Outstanding for the Current Year 10,000

1,10,300

Less : Outstanding for the previous year 9,000

1,01,300

Add : Received in advance in previous year 8,000

1,09,300

Less : Received in advance during current year 6,000

As per Income and Expenditure Account 1,03,300

HHHHHHHHHHHHH EXERCISE - 2 HHHHHHHHHHHHH

Q.1 Objective Type Questions:

A) Select the most appropriative alternatives from those given below.

1. Not for Profit Concern renders ............. services to public at large.

a) Commercial b) Social c) Individual d) Group

2. Donation for Scholarship Fund is .............

a) Capital Receipt b) Revenue Receipt

c) Capital Expenditure d) Revenue Expenditure

3. Income and Expenditure Account is a ........... Account

a) Capital b) Real c) Personal d) Nominal

4. Outstanding subscription at the end of the Accounting Year represents ...........

a) Liability b) An Expenditure c) An Asset d) Capital Fund

111