Page 237 - VIRANSH COACHING CLASSES

P. 237

(When one Partner become Insolvent)

Illustrations

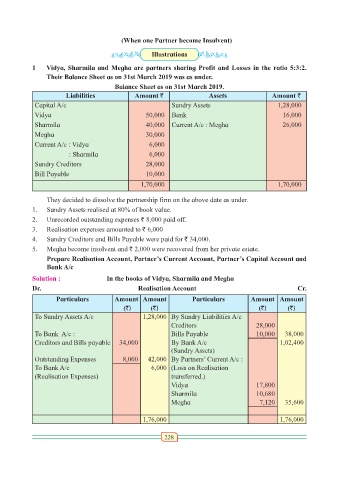

1 Vidya, Sharmila and Megha are partners sharing Profit and Losses in the ratio 5:3:2.

Their Balance Sheet as on 31st March 2019 was as under.

Balance Sheet as on 31st March 2019.

Liabilities Amount ` Assets Amount `

Capital A/c Sundry Assets 1,28,000

Vidya 50,000 Bank 16,000

Sharmila 40,000 Current A/c : Megha 26,000

Megha 30,000

Current A/c : Vidya 6,000

: Sharmila 6,000

Sundry Creditors 28,000

Bill Payable 10,000

1,70,000 1,70,000

They decided to dissolve the partnership firm on the above date as under.

1. Sundry Assets realised at 80% of book value.

2. Unrecorded outstanding expenses ` 8,000 paid off.

3. Realisation expenses amounted to ` 6,000

4. Sundry Creditors and Bills Payable were paid for ` 34,000.

5. Megha become insolvent and ` 2,000 were recovered from her private estate.

Prepare Realisation Account, Partner’s Current Account, Partner’s Capital Account and

Bank A/c

Solution : In the books of Vidya, Sharmila and Megha

Dr. Realisation Account Cr.

Particulars Amount Amount Particulars Amount Amount

(`) (`) (`) (`)

To Sundry Assets A/c 1,28,000 By Sundry Liabilities A/c

Creditors 28,000

To Bank A/c : Bills Payable 10,000 38,000

Creditors and Bills payable 34,000 By Bank A/c 1,02,400

(Sundry Assets)

Outstanding Expenses 8,000 42,000 By Partners’ Current A/c :

To Bank A/c 6,000 (Loss on Realisation

(Realisation Expenses) transferred.)

Vidya 17,800

Sharmila 10,680

Megha 7,120 35,600

1,76,000 1,76,000

228