Page 241 - VIRANSH COACHING CLASSES

P. 241

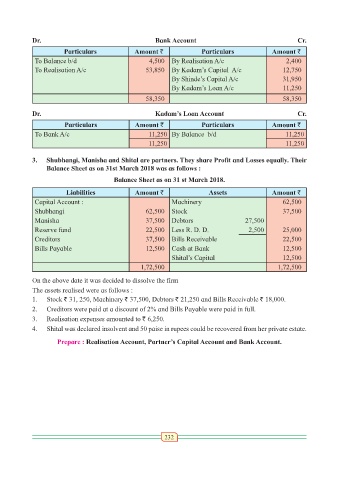

Dr. Bank Account Cr.

Particulars Amount ` Particulars Amount `

To Balance b/d 4,500 By Realisation A/c 2,400

To Realisation A/c 53,850 By Kadam’s Capital A/c 12,750

By Shinde’s Capital A/c 31,950

By Kadam’s Loan A/c 11,250

58,350 58,350

Dr. Kadam’s Loan Account Cr.

Particulars Amount ` Particulars Amount `

To Bank A/c 11,250 By Balance b/d 11,250

11,250 11,250

3. Shubhangi, Manisha and Shital are partners. They share Profit and Losses equally. Their

Balance Sheet as on 31st March 2018 was as follows :

Balance Sheet as on 31 st March 2018.

Liabilities Amount ` Assets Amount `

Capital Account : Machinery 62,500

Shubhangi 62,500 Stock 37,500

Manisha 37,500 Debtors 27,500

Reserve fund 22,500 Less R. D. D. 2,500 25,000

Creditors 37,500 Bills Receivable 22,500

Bills Payable 12,500 Cash at Bank 12,500

Shital’s Capital 12,500

1,72,500 1,72,500

On the above date it was decided to dissolve the firm

The assets realised were as follows :

1. Stock ` 31, 250, Machinery ` 37,500, Debtors ` 21,250 and Bills Receivable ` 18,000.

2. Creditors were paid at a discount of 2% and Bills Payable were paid in full.

3. Realisation expenses amounted to ` 6,250.

4. Shital was declared insolvent and 50 paise in rupees could be recovered from her private estate.

Prepare : Realisation Account, Partner’s Capital Account and Bank Account.

232