Page 333 - VIRANSH COACHING CLASSES

P. 333

8.2.5 Calls in Arrears & Calls in Advance

(A) Call in Arrears

If the company accept the application and allots the shares to the person he becomes the shareholder

and the shareholder is liable to pay the entire amount of shares. In case he fails to pay the allotment

and calls on shares held by him the unpaid amount is known as Calls in Arrears.

The unpaid amount on allotment and calls may be kept in their respective accounts for the balance not

received or may be transferred to a new account i.e. Calls in Arrears Account. The Calls in Arrears

Account has debit balance which is shown as a deduction from the Paid up Share Capital on liabilities

side of Balance sheet.

8 Girish & Co. Ltd. Invited applications for 25000 equity shares of ` 10 each payable as

` 2.50 on Application

` 5 on Allotment

` 2.50 on First & Final call

` Applications were received for 30000 equity shares and pro-rata allotment were made to all.

All the money was duly received except First and Final call on 2500 equity shares.

Enter the above transactions in the books of a company and show the Balance sheet.

Solution :

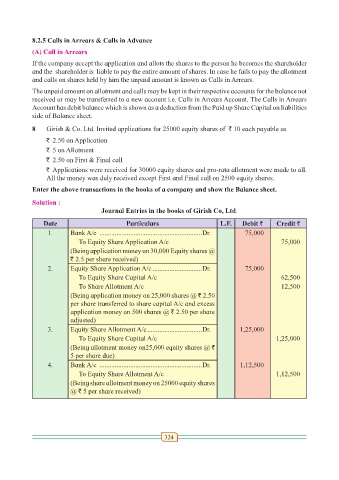

Journal Entries in the books of Girish Co, Ltd.

Date Particulars L.F. Debit ` Credit `

1. Bank A/c ............................................................Dr. 75,000

To Equity Share Application A/c 75,000

(Being application money on 30,000 Equity shares @

` 2.5 per share received)

2. Equity Share Application A/c .............................Dr. 75,000

To Equity Share Capital A/c 62,500

To Share Allotment A/c 12,500

(Being application money on 25,000 shares @ ` 2.50

per share transferred to share capital A/c and excess

application money on 500 shares @ ` 2.50 per share

adjusted)

3. Equity Share Allotment A/c ................................Dr. 1,25,000

To Equity Share Capital A/c 1,25,000

(Being allotment money on25,000 equity shares @ `

5 per share due)

4. Bank A/c ............................................................Dr. 1,12,500

To Equity Share Allotment A/c 1,12,500

(Being share allotment money on 25000 equity shares

@ ` 5 per share received)

324