Page 39 - C&A's Nonprofit Board Guide

P. 39

WHAT THE BOARD OF DIRECTORS SHOULD KNOW ABOUT IRS FORM 990

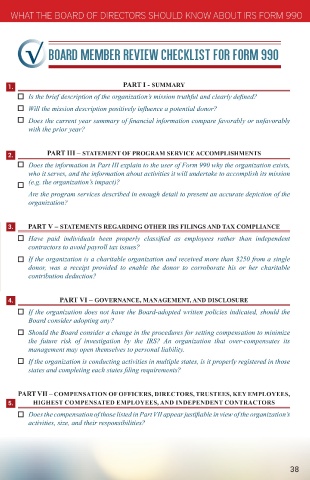

√ BOARD MEMBER REVIEW CHECKLIST FOR FORM 990

1. PART I - SUMMARY

Is the brief description of the organization’s mission truthful and clearly defined?

Will the mission description positively influence a potential donor?

Does the current year summary of financial information compare favorably or unfavorably

with the prior year?

2. PART III – STATEMENT OF PROGRAM SERVICE ACCOMPLISHMENTS

Does the information in Part III explain to the user of Form 990 why the organization exists,

who it serves, and the information about activities it will undertake to accomplish its mission

(e.g. the organization’s impact)?

Are the program services described in enough detail to present an accurate depiction of the

organization?

IRS FORM 990

3. PART V – STATEMENTS REGARDING OTHER IRS FILINGS AND TAX COMPLIANCE

WHAT THE BOARD OF DIRECTORS SHOULD KNOW ABOUT

Have paid individuals been properly classified as employees rather than independent

contractors to avoid payroll tax issues?

If the organization is a charitable organization and received more than $250 from a single

donor, was a receipt provided to enable the donor to corroborate his or her charitable

contribution deduction?

4. PART VI – GOVERNANCE, MANAGEMENT, AND DISCLOSURE

RS Form 990 is an informational tax form that the majority of tax-exempt organizations

I must file annually. The Form’s main purpose is to give the IRS an overview of the If the organization does not have the Board-adopted written policies indicated, should the

organization’s activities, governance, and detailed financial information. Additionally, Board consider adopting any?

Form 990 includes a section to describe the organization’s accomplishments in the previous year Should the Board consider a change in the procedures for setting compensation to minimize

to justify maintaining its tax-exempt status. The IRS uses the information reported in Form 990 the future risk of investigation by the IRS? An organization that over-compensates its

to ensure that organizations continue to qualify for tax-exempt status. management may open themselves to personal liability.

Federal tax law does not define that it is the Board’s duty to receive or review a Form 990, but If the organization is conducting activities in multiple states, is it properly registered in those

organizations who do not have a Board review policy in place may be considered to have a states and completing each states filing requirements?

significant weakness and lack of oversight. There has been a substantial increase in the demand

for transparency and accountability within the nonprofit sector, further cementing the importance

of the Board’s involvement in the review of the organization’s Form 990. PART VII – COMPENSATION OF OFFICERS, DIRECTORS, TRUSTEES, KEY EMPLOYEES,

5. HIGHEST COMPENSATED EMPLOYEES, AND INDEPENDENT CONTRACTORS

Does the compensation of those listed in Part VII appear justifiable in view of the organization’s

activities, size, and their responsibilities?

The following “Board Member Review Checklist for Form

990” highlights some key areas that Board members should

examine as a part of their review of Form 990.

37 38