Page 10 - What Momma Didn't Teach Us - Credit Edition

P. 10

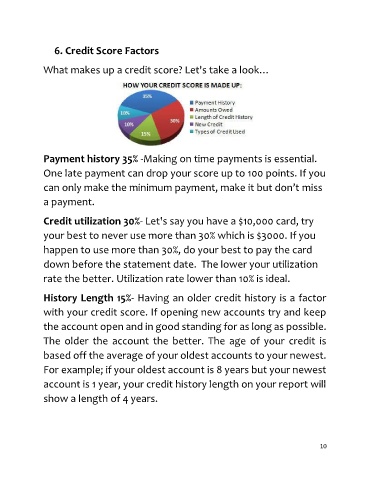

6. Credit Score Factors

What makes up a credit score? Let's take a look…

Payment history 35% -Making on time payments is essential.

One late payment can drop your score up to 100 points. If you

can only make the minimum payment, make it but don’t miss

a payment.

Credit utilization 30%- Let's say you have a $10,000 card, try

your best to never use more than 30% which is $3000. If you

happen to use more than 30%, do your best to pay the card

down before the statement date. The lower your utilization

rate the better. Utilization rate lower than 10% is ideal.

History Length 15%- Having an older credit history is a factor

with your credit score. If opening new accounts try and keep

the account open and in good standing for as long as possible.

The older the account the better. The age of your credit is

based off the average of your oldest accounts to your newest.

For example; if your oldest account is 8 years but your newest

account is 1 year, your credit history length on your report will

show a length of 4 years.

10