Page 8 - What Momma Didn't Teach Us - Credit Edition

P. 8

4. Understanding a credit score

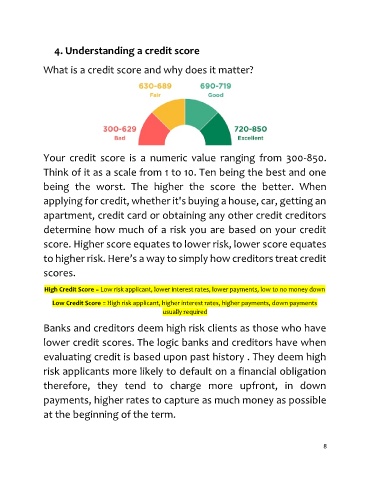

What is a credit score and why does it matter?

Your credit score is a numeric value ranging from 300-850.

Think of it as a scale from 1 to 10. Ten being the best and one

being the worst. The higher the score the better. When

applying for credit, whether it's buying a house, car, getting an

apartment, credit card or obtaining any other credit creditors

determine how much of a risk you are based on your credit

score. Higher score equates to lower risk, lower score equates

to higher risk. Here’s a way to simply how creditors treat credit

scores.

High Credit Score = Low risk applicant, lower interest rates, lower payments, low to no money down

Low Credit Score = High risk applicant, higher interest rates, higher payments, down payments

usually required

Banks and creditors deem high risk clients as those who have

lower credit scores. The logic banks and creditors have when

evaluating credit is based upon past history . They deem high

risk applicants more likely to default on a financial obligation

therefore, they tend to charge more upfront, in down

payments, higher rates to capture as much money as possible

at the beginning of the term.

8