Page 31 - Estate Planning Documents

P. 31

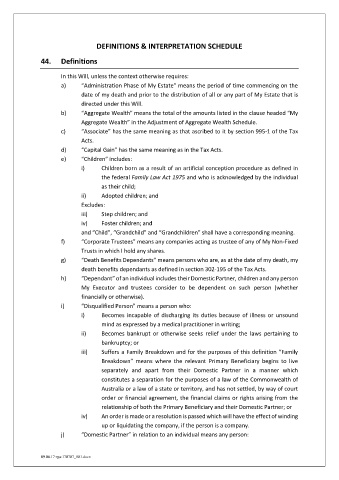

DEFINITIONS & INTERPRETATION SCHEDULE

44. Definitions

In this Will, unless the context otherwise requires:

a) “Administration Phase of My Estate” means the period of time commencing on the

date of my death and prior to the distribution of all or any part of My Estate that is

directed under this Will.

b) “Aggregate Wealth” means the total of the amounts listed in the clause headed “My

Aggregate Wealth” in the Adjustment of Aggregate Wealth Schedule.

c) “Associate” has the same meaning as that ascribed to it by section 995-1 of the Tax

Acts.

d) “Capital Gain” has the same meaning as in the Tax Acts.

e) “Children” includes:

i) Children born as a result of an artificial conception procedure as defined in

the federal Family Law Act 1975 and who is acknowledged by the individual

as their child;

ii) Adopted children; and

Excludes:

iii) Step children; and

iv) Foster children; and

and “Child”, “Grandchild” and “Grandchildren” shall have a corresponding meaning.

f) “Corporate Trustees” means any companies acting as trustee of any of My Non-Fixed

Trusts in which I hold any shares.

g) “Death Benefits Dependants” means persons who are, as at the date of my death, my

death benefits dependants as defined in section 302-195 of the Tax Acts.

h) “Dependant” of an individual includes their Domestic Partner, children and any person

My Executor and trustees consider to be dependent on such person (whether

financially or otherwise).

i) “Disqualified Person” means a person who:

i) Becomes incapable of discharging its duties because of illness or unsound

mind as expressed by a medical practitioner in writing;

ii) Becomes bankrupt or otherwise seeks relief under the laws pertaining to

bankruptcy; or

iii) Suffers a Family Breakdown and for the purposes of this definition “Family

Breakdown” means where the relevant Primary Beneficiary begins to live

separately and apart from their Domestic Partner in a manner which

constitutes a separation for the purposes of a law of the Commonwealth of

Australia or a law of a state or territory, and has not settled, by way of court

order or financial agreement, the financial claims or rights arising from the

relationship of both the Primary Beneficiary and their Domestic Partner; or

iv) An order is made or a resolution is passed which will have the effect of winding

up or liquidating the company, if the person is a company.

j) “Domestic Partner” in relation to an individual means any person:

09.06.17:rga:170707_001.docx