Page 26 - LGB Group

P. 26

d) The Company shall reimburse the expenses related to leave passage only

upon the completion of such leave passage by the Employee. The claimable

expenses related to leave passage include:

(i) airfare, land transport, meals & drinks, admission tickets, toll & parking

(ii) hotel accommodation, package tours etc.

e) An Employee may utilise the leave passage in any combination of

(i) overseas trip, or

(ii) local trips

f) An Employee cannot claim for the leave passage if he did not personally

partake in such trips.

g) All original copies of receipts, vouchers, tickets, full tax invoices etc. must be

submitted together with the expense claim form. Photostat copies or scanned

copies are not acceptable.

h) Employees should note that the Leave Passage is treated as “Benefit in Kind”

under the Income Tax regulations and is subject to personal income tax in

accordance with prevailing regulations.

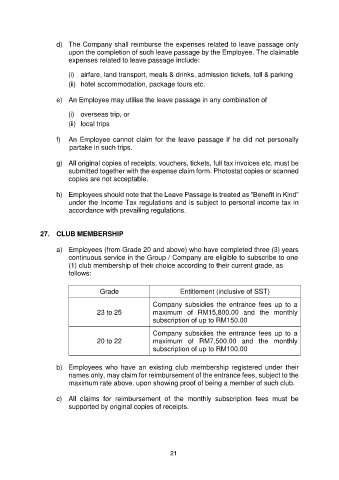

27. CLUB MEMBERSHIP

a) Employees (from Grade 20 and above) who have completed three (3) years

continuous service in the Group / Company are eligible to subscribe to one

(1) club membership of their choice according to their current grade, as

follows:

Grade Entitlement (inclusive of SST)

Company subsidies the entrance fees up to a

23 to 25 maximum of RM15,800.00 and the monthly

subscription of up to RM150.00

Company subsidies the entrance fees up to a

20 to 22 maximum of RM7,500.00 and the monthly

subscription of up to RM100.00

b) Employees who have an existing club membership registered under their

names only, may claim for reimbursement of the entrance fees, subject to the

maximum rate above, upon showing proof of being a member of such club.

c) All claims for reimbursement of the monthly subscription fees must be

supported by original copies of receipts.

21