Page 243 - Dimensi Baharu Zakat di Malaysia

P. 243

© DIMENSI BAHARU ZAKAT DI MALAYSIA

ISBN 978-967-2959-04-5

90

80

70

60

50

40

(%) 30

20

10

0

-10 1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9

-20

Zakat collection GDP growth Inflation rate

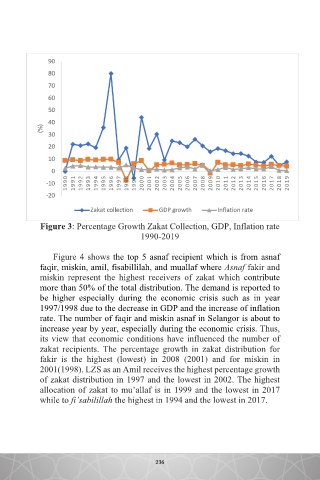

Figure 3: Percentage Growth Zakat Collection, GDP, Inflation rate

1990-2019

Figure 4 shows the top 5 asnaf recipient which is from asnaf

faqir, miskin, amil, fisabillilah, and muallaf where Asnaf fakir and

miskin represent the highest receivers of zakat which contribute

more than 50% of the total distribution. The demand is reported to

be higher especially during the economic crisis such as in year

1997/1998 due to the decrease in GDP and the increase of inflation

rate. The number of faqir and miskin asnaf in Selangor is about to

increase year by year, especially during the economic crisis. Thus,

its view that economic conditions have influenced the number of

zakat recipients. The percentage growth in zakat distribution for

fakir is the highest (lowest) in 2008 (2001) and for miskin in

2001(1998). LZS as an Amil receives the highest percentage growth

of zakat distribution in 1997 and the lowest in 2002. The highest

allocation of zakat to mu’allaf is in 1999 and the lowest in 2017

while to fi’sabilillah the highest in 1994 and the lowest in 2017.

235

236