Page 634 - COSO Guidance

P. 634

5. Information, communication and reporting for ESG-related risks

Internal stakeholders: Communicating and reporting

Communication of risk information is critical to improving decisions relating to strategy-setting and day-to-day

operations. Internal communication of ESG-related risks in particular can help to:

• Inform the board of directors and management how

ESG-related risks will impact the business strategy and Guidance

objectives: This can help the board and management to

make informed decisions and seize opportunities. Communicate and report relevant

• Promote awareness of critical ESG-related risks to ESG-related risk information

the entity: Such awareness can support better day-to-day internally for decision-making

decision-making and allocation of adequate resources to

address the risk.

• Encourage a culture of risk awareness and employee engagement throughout the organization:

For example, an airline may communicate aggregated safety data to employees to allow them to understand

how they contribute to the airline’s or airport’s safety performance. A typical safety newsletter captures both

leading (e.g., number of employees trained on safety) and lagging (e.g., incident rate) indicators.

Communication on risk varies depending on the audience (e.g., board of directors versus operational

management) and information needs of each stakeholder (e.g., the need to understand the details of an

entity’s risk response versus overall effectiveness). Table 5.1 provides examples of the considerations that risk

management and sustainability practitioners should consider when preparing communications for specific

audiences based on the escalation paths defined by the organization.

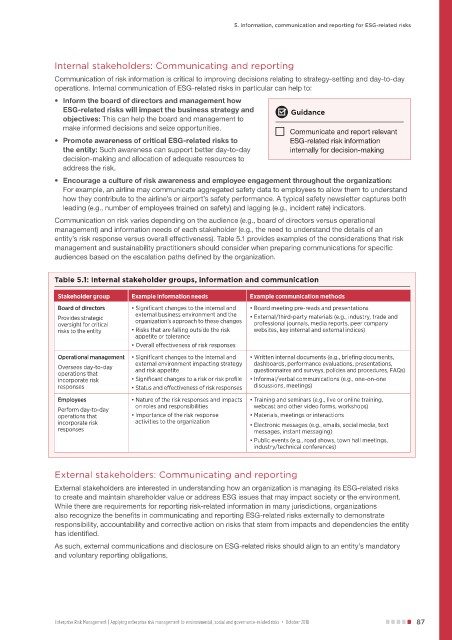

Table 5.1: Internal stakeholder groups, information and communication

Stakeholder group Example information needs Example communication methods

Board of directors • Significant changes to the internal and • Board meeting pre-reads and presentations

external business environment and the

Provides strategic organization’s approach to these changes • External/third-party materials (e.g., industry, trade and

oversight for critical professional journals, media reports, peer company

risks to the entity • Risks that are falling outside the risk websites, key internal and external indices)

appetite or tolerance

• Overall effectiveness of risk responses

Operational management • Significant changes to the internal and • Written internal documents (e.g., briefing documents,

external environment impacting strategy dashboards, performance evaluations, presentations,

Oversees day-to-day and risk appetite questionnaires and surveys, policies and procedures, FAQs)

operations that

incorporate risk • Significant changes to a risk or risk profile • Informal/verbal communications (e.g., one-on-one

responses • Status and effectiveness of risk responses discussions, meetings)

Employees • Nature of the risk responses and impacts • Training and seminars (e.g., live or online training,

on roles and responsibilities webcast and other video forms, workshops)

Perform day-to-day

operations that • Importance of the risk response • Materials, meetings or interactions

incorporate risk activities to the organization • Electronic messages (e.g., emails, social media, text

responses messages, instant messaging)

• Public events (e.g., road shows, town hall meetings,

industry/technical conferences)

External stakeholders: Communicating and reporting

External stakeholders are interested in understanding how an organization is managing its ESG-related risks

to create and maintain shareholder value or address ESG issues that may impact society or the environment.

While there are requirements for reporting risk-related information in many jurisdictions, organizations

also recognize the benefits in communicating and reporting ESG-related risks externally to demonstrate

responsibility, accountability and corrective action on risks that stem from impacts and dependencies the entity

has identified.

As such, external communications and disclosure on ESG-related risks should align to an entity’s mandatory

and voluntary reporting obligations.

Enterprise Risk Management | Applying enterprise risk management to environmental, social and governance-related risks • October 2018 87