Page 636 - COSO Guidance

P. 636

5. Information, communication and reporting for ESG-related risks

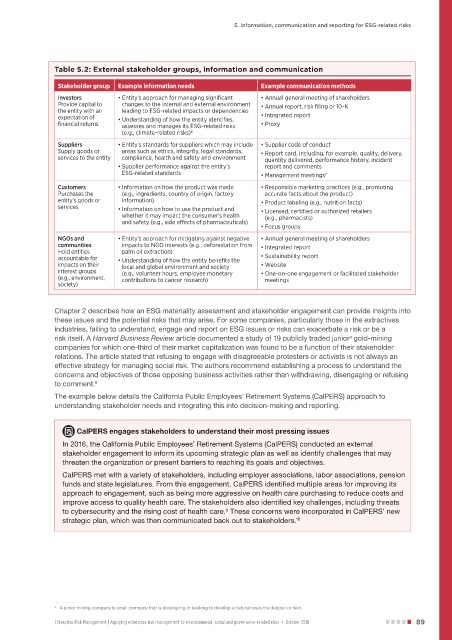

Table 5.2: External stakeholder groups, information and communication

Stakeholder group Example information needs Example communication methods

Investors • Entity’s approach for managing significant • Annual general meeting of shareholders

Provide capital to changes to the internal and external environment • Annual report, risk filing or 10-K

the entity with an leading to ESG-related impacts or dependencies

expectation of • Understanding of how the entity identifies, • Integrated report

financial returns assesses and manages its ESG-related risks • Proxy

(e.g., climate-related risks)6

Suppliers • Entity’s standards for suppliers which may include • Supplier code of conduct

Supply goods or areas such as ethics, integrity, legal standards, • Report card, including, for example, quality, delivery,

services to the entity compliance, health and safety and environment quantity delivered, performance history, incident

• Supplier performance against the entity’s report and comments

ESG-related standards • Management meetings7

Customers • Information on how the product was made • Responsible marketing practices (e.g., promoting

Purchases the (e.g., ingredients, country of origin, factory accurate facts about the product)

entity’s goods or information) • Product labeling (e.g., nutrition facts)

services • Information on how to use the product and

whether it may impact the consumer’s health • Licensed, certified or authorized retailers

(e.g., pharmacists)

and safety (e.g., side effects of pharmaceuticals)

• Focus groups

NGOs and • Entity’s approach for mitigating against negative • Annual general meeting of shareholders

communities impacts to NGO interests (e.g., deforestation from • Integrated report

Hold entities palm oil extraction)

accountable for • Understanding of how the entity benefits the • Sustainability report

impacts on their local and global environment and society • Website

interest groups (e.g., volunteer hours, employee monetary • One-on-one engagement or facilitated stakeholder

(e.g., environment, contributions to cancer research) meetings

society)

Chapter 2 describes how an ESG materiality assessment and stakeholder engagement can provide insights into

these issues and the potential risks that may arise. For some companies, particularly those in the extractives

industries, failing to understand, engage and report on ESG issues or risks can exacerbate a risk or be a

risk itself. A Harvard Business Review article documented a study of 19 publicly traded junior gold-mining

a

companies for which one-third of their market capitalization was found to be a function of their stakeholder

relations. The article stated that refusing to engage with disagreeable protesters or activists is not always an

effective strategy for managing social risk. The authors recommend establishing a process to understand the

concerns and objectives of those opposing business activities rather than withdrawing, disengaging or refusing

to comment. 8

The example below details the California Public Employees’ Retirement Systems (CalPERS) approach to

understanding stakeholder needs and integrating this into decision-making and reporting.

CalPERS engages stakeholders to understand their most pressing issues

In 2016, the California Public Employees’ Retirement Systems (CalPERS) conducted an external

stakeholder engagement to inform its upcoming strategic plan as well as identify challenges that may

threaten the organization or present barriers to reaching its goals and objectives.

CalPERS met with a variety of stakeholders, including employer associations, labor associations, pension

funds and state legislatures. From this engagement, CalPERS identified multiple areas for improving its

approach to engagement, such as being more aggressive on health care purchasing to reduce costs and

improve access to quality health care. The stakeholders also identified key challenges, including threats

9

to cybersecurity and the rising cost of health care. These concerns were incorporated in CalPERS’ new

10

strategic plan, which was then communicated back out to stakeholders.

. . . . . . . . . . . . . . . .

a A junior mining company is small company that is developing or seeking to develop a natural resource deposit or field.

Enterprise Risk Management | Applying enterprise risk management to environmental, social and governance-related risks • October 2018 89