Page 638 - COSO Guidance

P. 638

5. Information, communication and reporting for ESG-related risks

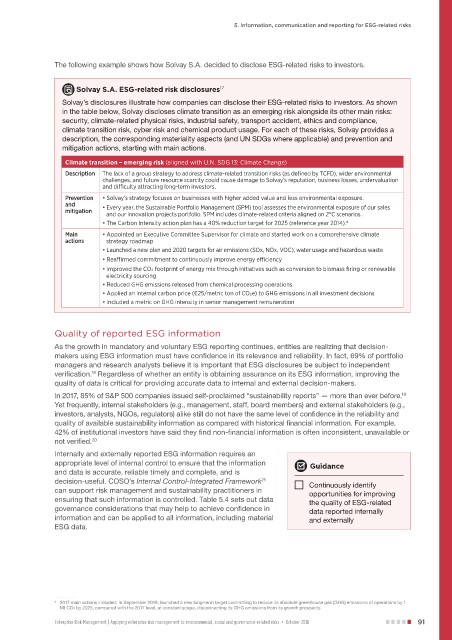

The following example shows how Solvay S.A. decided to disclose ESG-related risks to investors.

Solvay S.A. ESG-related risk disclosures 17

Solvay’s disclosures illustrate how companies can disclose their ESG-related risks to investors. As shown

in the table below, Solvay discloses climate transition as an emerging risk alongside its other main risks:

security, climate-related physical risks, industrial safety, transport accident, ethics and compliance,

climate transition risk, cyber risk and chemical product usage. For each of these risks, Solvay provides a

description, the corresponding materiality aspects (and UN SDGs where applicable) and prevention and

mitigation actions, starting with main actions.

Climate transition – emerging risk (aligned with U.N. SDG 13: Climate Change)

Description The lack of a group strategy to address climate-related transition risks (as defined by TCFD), wider environmental

challenges, and future resource scarcity could cause damage to Solvay’s reputation, business losses, undervaluation

and difficulty attracting long-term investors.

Prevention • Solvay’s strategy focuses on businesses with higher added value and less environmental exposure.

and • Every year, the Sustainable Portfolio Management (SPM) tool assesses the environmental exposure of our sales

mitigation

and our innovation projects portfolio. SPM includes climate-related criteria aligned on 2°C scenarios.

• The Carbon Intensity action plan has a 40% reduction target for 2025 (reference year 2014). d

Main • Appointed an Executive Committee Supervisor for climate and started work on a comprehensive climate

actions strategy roadmap

• Launched a new plan and 2020 targets for air emissions (SOx, NOx, VOC), water usage and hazardous waste

• Reaffirmed commitment to continuously improve energy efficiency

• Improved the CO2 footprint of energy mix through initiatives such as conversion to biomass firing or renewable

electricity sourcing

• Reduced GHG emissions released from chemical processing operations

• Applied an internal carbon price (€25/metric ton of CO2e) to GHG emissions in all investment decisions

• Included a metric on GHG intensity in senior management remuneration

Quality of reported ESG information

As the growth in mandatory and voluntary ESG reporting continues, entities are realizing that decision-

makers using ESG information must have confidence in its relevance and reliability. In fact, 69% of portfolio

managers and research analysts believe it is important that ESG disclosures be subject to independent

verification. Regardless of whether an entity is obtaining assurance on its ESG information, improving the

18

quality of data is critical for providing accurate data to internal and external decision-makers.

In 2017, 85% of S&P 500 companies issued self-proclaimed “sustainability reports” — more than ever before.

19

Yet frequently, internal stakeholders (e.g., management, staff, board members) and external stakeholders (e.g.,

investors, analysts, NGOs, regulators) alike still do not have the same level of confidence in the reliability and

quality of available sustainability information as compared with historical financial information. For example,

42% of institutional investors have said they find non-financial information is often inconsistent, unavailable or

not verified.

20

Internally and externally reported ESG information requires an

appropriate level of internal control to ensure that the information Guidance

and data is accurate, reliable timely and complete, and is

decision-useful. COSO’s Internal Control-Integrated Framework Continuously identify

21

can support risk management and sustainability practitioners in opportunities for improving

ensuring that such information is controlled. Table 5.4 sets out data the quality of ESG-related

governance considerations that may help to achieve confidence in data reported internally

information and can be applied to all information, including material and externally

ESG data.

. . . . . . . . . . . . . . . .

d 2017 main actions included: In September 2018, launched a new long-term target committing to reduce its absolute greenhouse gas (GHG) emissions of operations by 1

Mt CO2 by 2025, compared with the 2017 level, at constant scope, disconnecting its GHG emissions from its growth prospects

Enterprise Risk Management | Applying enterprise risk management to environmental, social and governance-related risks • October 2018 91