Page 639 - COSO Guidance

P. 639

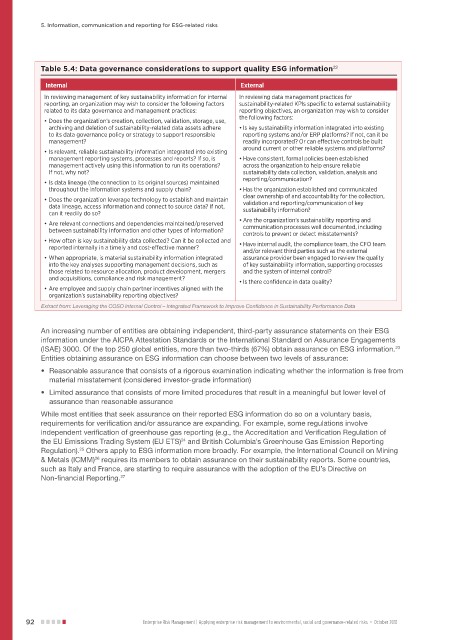

5. Information, communication and reporting for ESG-related risks

Table 5.4: Data governance considerations to support quality ESG information

22

Internal External

In reviewing management of key sustainability information for internal In reviewing data management practices for

reporting, an organization may wish to consider the following factors sustainability-related KPIs specific to external sustainability

related to its data governance and management practices: reporting objectives, an organization may wish to consider

the following factors:

• Does the organization’s creation, collection, validation, storage, use,

archiving and deletion of sustainability-related data assets adhere • Is key sustainability information integrated into existing

to its data governance policy or strategy to support responsible reporting systems and/or ERP platforms? If not, can it be

management? readily incorporated? Or can effective controls be built

• Is relevant, reliable sustainability information integrated into existing around current or other reliable systems and platforms?

management reporting systems, processes and reports? If so, is • Have consistent, formal policies been established

management actively using this information to run its operations? across the organization to help ensure reliable

If not, why not? sustainability data collection, validation, analysis and

reporting/communication?

• Is data lineage (the connection to its original sources) maintained

throughout the information systems and supply chain? • Has the organization established and communicated

• Does the organization leverage technology to establish and maintain clear ownership of and accountability for the collection,

data lineage, access information and connect to source data? If not, validation and reporting/communication of key

can it readily do so? sustainability information?

• Are the organization’s sustainability reporting and

• Are relevant connections and dependencies maintained/preserved communication processes well documented, including

between sustainability information and other types of information? controls to prevent or detect misstatements?

• How often is key sustainability data collected? Can it be collected and

reported internally in a timely and cost-effective manner? • Have internal audit, the compliance team, the CFO team

and/or relevant third parties such as the external

• When appropriate, is material sustainability information integrated assurance provider been engaged to review the quality

into the key analyses supporting management decisions, such as of key sustainability information, supporting processes

those related to resource allocation, product development, mergers and the system of internal control?

and acquisitions, compliance and risk management? • Is there confidence in data quality?

• Are employee and supply chain partner incentives aligned with the

organization’s sustainability reporting objectives?

Extract from: Leveraging the COSO Internal Control – Integrated Framework to Improve Confidence in Sustainability Performance Data

An increasing number of entities are obtaining independent, third-party assurance statements on their ESG

information under the AICPA Attestation Standards or the International Standard on Assurance Engagements

(ISAE) 3000. Of the top 250 global entities, more than two-thirds (67%) obtain assurance on ESG information.

23

Entities obtaining assurance on ESG information can choose between two levels of assurance:

• Reasonable assurance that consists of a rigorous examination indicating whether the information is free from

material misstatement (considered investor-grade information)

• Limited assurance that consists of more limited procedures that result in a meaningful but lower level of

assurance than reasonable assurance

While most entities that seek assurance on their reported ESG information do so on a voluntary basis,

requirements for verification and/or assurance are expanding. For example, some regulations involve

independent verification of greenhouse gas reporting (e.g., the Accreditation and Verification Regulation of

24

the EU Emissions Trading System (EU ETS) and British Columbia’s Greenhouse Gas Emission Reporting

25

Regulation). Others apply to ESG information more broadly. For example, the International Council on Mining

& Metals (ICMM) requires its members to obtain assurance on their sustainability reports. Some countries,

26

such as Italy and France, are starting to require assurance with the adoption of the EU’s Directive on

Non-financial Reporting.

27

92 Enterprise Risk Management | Applying enterprise risk management to environmental, social and governance-related risks • October 2018