Page 219 - ACFE Fraud Reports 2009_2020

P. 219

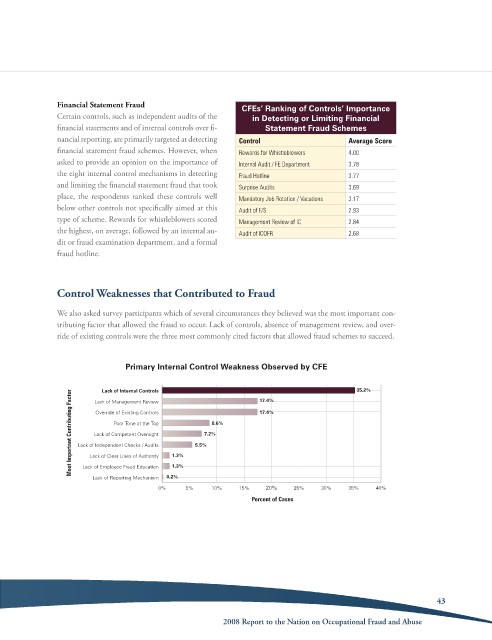

Financial Statement Fraud CFEs’ Ranking of Controls’ Importance

certain controls, such as independent audits of the in Detecting or Limiting Financial

financial statements and of internal controls over fi- Statement Fraud Schemes

nancial reporting, are primarily targeted at detecting Control Average Score

financial statement fraud schemes. However, when Rewards for Whistleblowers 4.00

asked to provide an opinion on the importance of Internal Audit / FE Department 3.78

the eight internal control mechanisms in detecting Fraud Hotline 3.77

and limiting the financial statement fraud that took Surprise Audits 3.69

place, the respondents ranked these controls well Mandatory Job Rotation / Vacations 3.17

below other controls not specifically aimed at this Audit of F/S 2.93

type of scheme. rewards for whistleblowers scored Management Review of IC 2.84

the highest, on average, followed by an internal au- Audit of ICOFR 2.68

dit or fraud examination department, and a formal

fraud hotline.

Control Weaknesses that Contributed to Fraud

We also asked survey participants which of several circumstances they believed was the most important con-

tributing factor that allowed the fraud to occur. lack of controls, absence of management review, and over-

ride of existing controls were the three most commonly cited factors that allowed fraud schemes to succeed.

Primary Internal Control Weakness Observed by CFE 35.2%

Lack of Internal Controls

Most Important Contributing Factor Lack of Independent Checks / Audits 1.3% 5.5% 7.2% 17.4%

Lack of Management Review

Override of Existing Controls

17.4%

8.6%

Poor Tone at the Top

Lack of Competent Oversight

Lack of Clear Lines of Authority

1.3%

Lack of Employee Fraud Education

Lack of Reporting Mechanism 0.2%

0% 5% 10% 15% 20% 25% 30% 35% 40%

Percent of Cases

43

2008 Report to the Nation on occupational Fraud and abuse