Page 362 - ACFE Fraud Reports 2009_2020

P. 362

Anti-Fraud Controls at Small Businesses

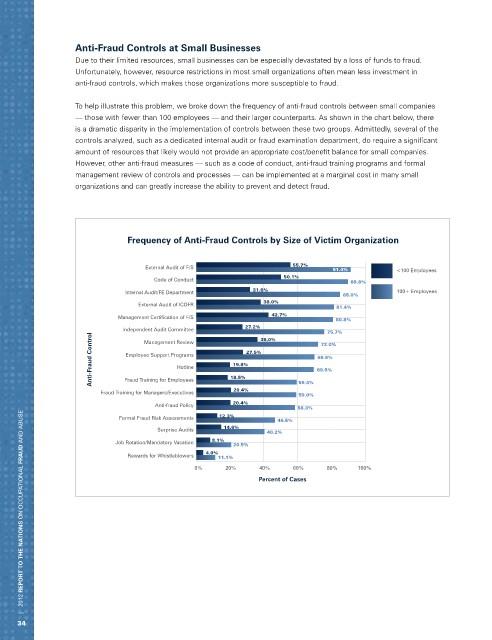

Due to their limited resources, small businesses can be especially devastated by a loss of funds to fraud.

Unfortunately, however, resource restrictions in most small organizations often mean less investment in

anti-fraud controls, which makes those organizations more susceptible to fraud.

To help illustrate this problem, we broke down the frequency of anti-fraud controls between small companies

— those with fewer than 100 employees — and their larger counterparts. As shown in the chart below, there

is a dramatic disparity in the implementation of controls between these two groups. Admittedly, several of the

controls analyzed, such as a dedicated internal audit or fraud examination department, do require a significant

amount of resources that likely would not provide an appropriate cost/benefit balance for small companies.

However, other anti-fraud measures — such as a code of conduct, anti-fraud training programs and formal

management review of controls and processes — can be implemented at a marginal cost in many small

organizations and can greatly increase the ability to prevent and detect fraud.

Frequency of Anti-Fraud Controls by Size of Victim Organization

External Audit of F/S 55.7% 91.4% <100 Employees

Code of Conduct 50.1% 89.8%

Internal Audit/FE Department 31.6% 85.0% 100+ Employees

38.0%

External Audit of ICOFR 81.4%

Management Certification of F/S 42.7% 80.8%

Independent Audit Committee 27.2% 36.0% 72.0%

75.7%

Anti-Fraud Control Employee Support Programs 19.8% 27.5% 69.5%

Management Review

69.8%

Hotline

Fraud Training for Employees

20.4%

Fraud Training for Managers/Executives 18.5% 59.4%

59.0%

Anti-fraud Policy 20.4%

58.3%

| 2012 REPORT TO THE NATIONS on occupational FRAUD and abuse

Formal Fraud Risk Assessments 12.3%

46.5%

Surprise Audits 14.6% 40.2%

Job Rotation/Mandatory Vacation 8.1%

20.5%

4.0%

Rewards for Whistleblowers 11.1%

0% 20% 40% 60% 80% 100%

Percent of Cases

34