Page 3 - Payroll Year-End Planning

P. 3

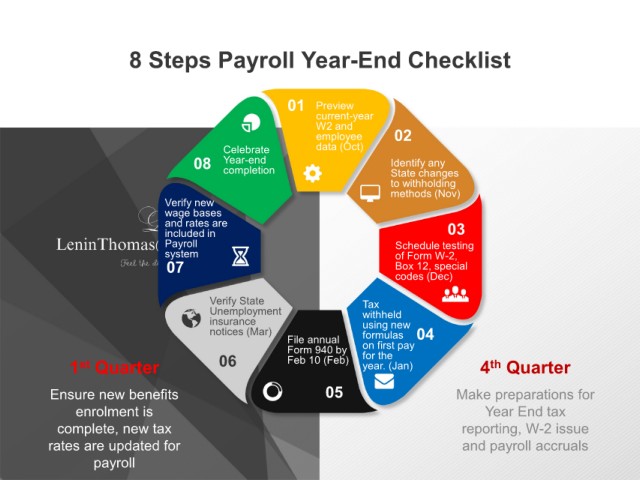

8 Steps Payroll Year-End Checklist

01 Preview

current-year

W2 and

employee 02

Celebrate data (Oct)

08 Year-end Identify any

completion

State changes

to withholding

methods (Nov)

Verify new

wage bases

and rates are

included in 03

Payroll Schedule testing

system of Form W-2,

07 Box 12, special

codes (Dec)

Verify State Tax

Unemployment withheld

insurance using new

notices (Mar) formulas 04

File annual on first pay

Form 940 by

1 Quarter 06 Feb 10 (Feb) for the 4 Quarter

th

st

year. (Jan)

Ensure new benefits 05 Make preparations for

enrolment is Year End tax

complete, new tax reporting, W-2 issue

rates are updated for and payroll accruals

payroll