Page 4 - Payroll Year-End Planning

P. 4

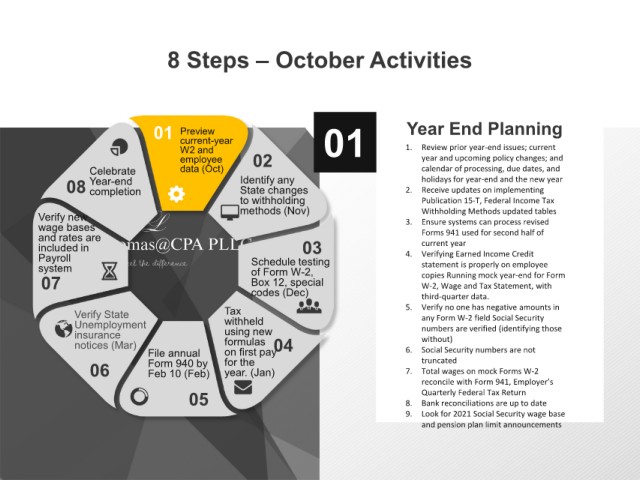

8 Steps – October Activities

01 Preview 01 Year End Planning

current-year

W2 and 1. Review prior year-end issues; current

employee 02 year and upcoming policy changes; and

Celebrate data (Oct) calendar of processing, due dates, and

08 Year-end Identify any 2. holidays for year-end and the new year

State changes

Receive updates on implementing

completion

to withholding Publication 15-T, Federal Income Tax

Verify new methods (Nov) Withholding Methods updated tables

wage bases 3. Ensure systems can process revised

and rates are Forms 941 used for second half of

included in 03 current year

Payroll Schedule testing 4. Verifying Earned Income Credit

system of Form W-2, statement is properly on employee

07 Box 12, special copies Running mock year-end for Form

W-2, Wage and Tax Statement, with

codes (Dec) third-quarter data.

Verify State Tax 5. Verify no one has negative amounts in

any Form W-2 field Social Security

Unemployment withheld numbers are verified (identifying those

insurance using new without)

notices (Mar) formulas 04

File annual on first pay 6. Social Security numbers are not

06 Form 940 by for the 7. truncated

Total wages on mock Forms W-2

year. (Jan)

Feb 10 (Feb)

reconcile with Form 941, Employer’s

05 8. Quarterly Federal Tax Return

Bank reconciliations are up to date

9. Look for 2021 Social Security wage base

and pension plan limit announcements