Page 9 - Payroll Year-End Planning

P. 9

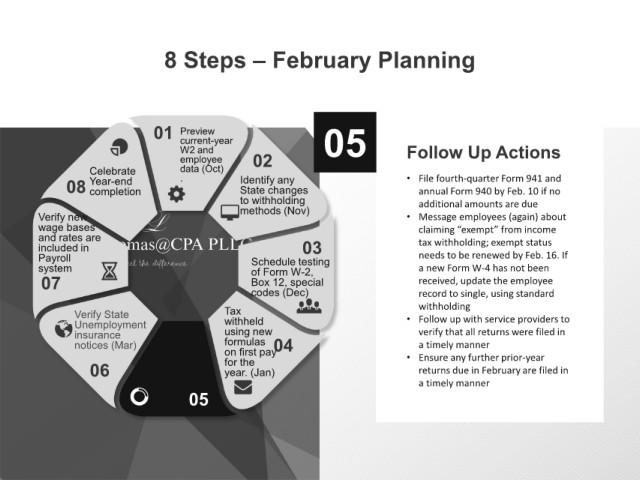

8 Steps – February Planning

01 Preview 05

current-year

W2 and Follow Up Actions

employee 02

Celebrate data (Oct)

08 Year-end . Identify any • File fourth-quarter Form 941 and

State changes

annual Form 940 by Feb. 10 if no

completion

to withholding additional amounts are due

Verify new methods (Nov) • Message employees (again) about

wage bases claiming “exempt” from income

and rates are tax withholding; exempt status

included in 03

Payroll Schedule testing needs to be renewed by Feb. 16. If

system of Form W-2, a new Form W-4 has not been

07 Box 12, special received, update the employee

codes (Dec) record to single, using standard

withholding

Verify State Tax • Follow up with service providers to

Unemployment withheld

insurance using new verify that all returns were filed in

notices (Mar) formulas 04 a timely manner

File annual on first pay • Ensure any further prior-year

06 Form 940 by for the returns due in February are filed in

year. (Jan)

Feb 10 (Feb)

a timely manner

05