Page 6 - Payroll Year-End Planning

P. 6

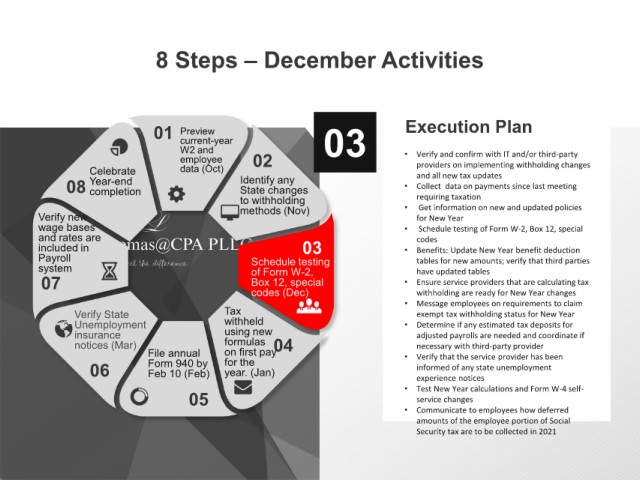

8 Steps – December Activities

01 Preview 03 Execution Plan

current-year

W2 and • Verify and confirm with IT and/or third-party

employee 02

Celebrate data (Oct) providers on implementing withholding changes

and all new tax updates

08 Year-end Identify any • Collect data on payments since last meeting

State changes

completion

to withholding • requiring taxation

Get information on new and updated policies

Verify new methods (Nov) for New Year

wage bases • Schedule testing of Form W-2, Box 12, special

and rates are codes

included in 03 • Benefits: Update New Year benefit deduction

Payroll Schedule testing tables for new amounts; verify that third parties

system of Form W-2, have updated tables

07 Box 12, special • Ensure service providers that are calculating tax

codes (Dec) withholding are ready for New Year changes

• Message employees on requirements to claim

Verify State Tax exempt tax withholding status for New Year

Unemployment withheld • Determine if any estimated tax deposits for

insurance using new adjusted payrolls are needed and coordinate if

notices (Mar) formulas 04 necessary with third-party provider

File annual on first pay • Verify that the service provider has been

06 Form 940 by for the informed of any state unemployment

year. (Jan)

Feb 10 (Feb)

experience notices

05 • Test New Year calculations and Form W-4 self-

service changes

• Communicate to employees how deferred

amounts of the employee portion of Social

Security tax are to be collected in 2021