Page 5 - Payroll Year-End Planning

P. 5

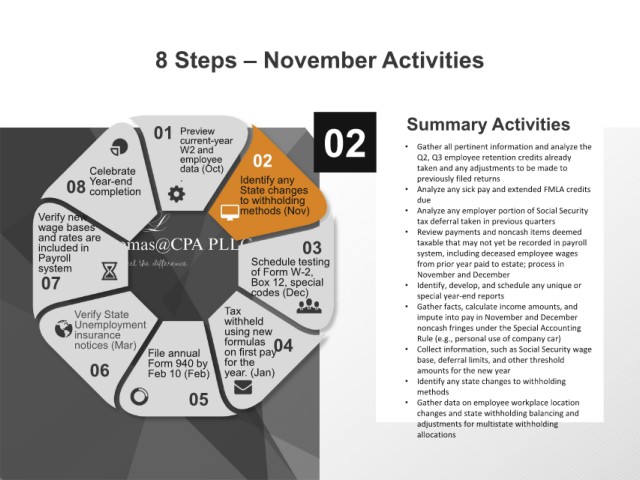

8 Steps – November Activities

01 Preview 02 Summary Activities

current-year

W2 and • Gather all pertinent information and analyze the

employee 02 Q2, Q3 employee retention credits already

Celebrate data (Oct) taken and any adjustments to be made to

08 Year-end . Identify any • previously filed returns

State changes

Analyze any sick pay and extended FMLA credits

completion

to withholding due

Verify new methods (Nov) • Analyze any employer portion of Social Security

tax deferral taken in previous quarters

wage bases • Review payments and noncash items deemed

and rates are

included in 03 taxable that may not yet be recorded in payroll

Payroll Schedule testing system, including deceased employee wages

system of Form W-2, from prior year paid to estate; process in

November and December

07 Box 12, special • Identify, develop, and schedule any unique or

codes (Dec) special year-end reports

Verify State Tax • Gather facts, calculate income amounts, and

impute into pay in November and December

Unemployment withheld noncash fringes under the Special Accounting

insurance using new Rule (e.g., personal use of company car)

notices (Mar) formulas 04

File annual on first pay • Collect information, such as Social Security wage

base, deferral limits, and other threshold

06 Form 940 by for the amounts for the new year

year. (Jan)

Feb 10 (Feb)

• Identify any state changes to withholding

05 • methods

Gather data on employee workplace location

changes and state withholding balancing and

adjustments for multistate withholding

allocations