Page 137 - 2020 Publication 17

P. 137

Page 135 of 138 Fileid: … ations/P17/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

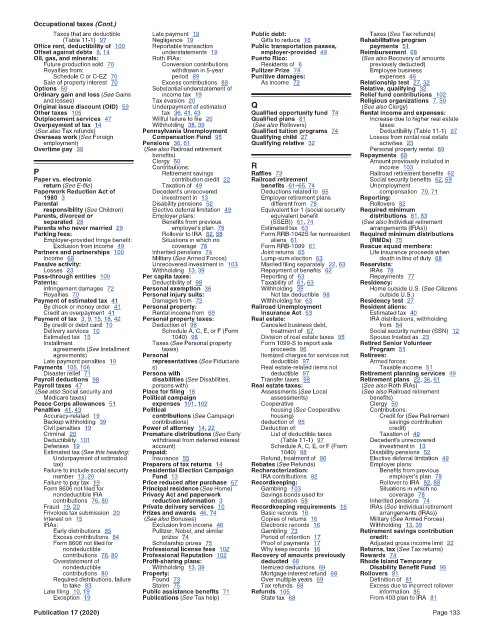

Occupational taxes (Cont.) 14:38 - 19-Jan-2021

Taxes that are deductible Late payment 19 Public debt: Taxes (See Tax refunds)

(Table 11-1) 97 Negligence 19 Gifts to reduce 16 Rehabilitative program

Office rent, deductibility of 100 Reportable transaction Public transportation passes, payments 51

Offset against debts 8, 14 understatements 19 employer-provided 49 Reimbursement 68

Oil, gas, and minerals: Roth IRAs: Puerto Rico: (See also Recovery of amounts

Future production sold 70 Conversion contributions Residents of 6 previously deducted)

Royalties from: withdrawn in 5-year Pulitzer Prize 74 Employee business

Schedule C or C-EZ 70 period 89 Punitive damages: expenses 46

Sale of property interest 70 Excess contributions 88 As income 72 Relationship test 27, 32

Options 50 Substantial understatement of Relative, qualifying 32

Ordinary gain and loss (See Gains income tax 19 Relief fund contributions 102

and losses) Tax evasion 20 Religious organizations 7, 50

Original issue discount (OID) 59 Underpayment of estimated Q (See also Clergy)

Other taxes 105 tax 36, 41, 43 Qualified opportunity fund 74 Rental income and expenses:

Outplacement services 47 Willful failure to file 20 Qualified plans 81 Increase due to higher real estate

Overpayment of tax 14 Withholding 38, 39 (See also Rollovers) taxes:

(See also Tax refunds) Pennsylvania Unemployment Qualified tuition programs 74 Deductibility (Table 11-1) 97

Overseas work (See Foreign Compensation Fund 95 Qualifying child 27 Losses from rental real estate

employment) Pensions 36, 61 Qualifying relative 32 activities 23

Overtime pay 38 (See also Railroad retirement Personal property rental 69

benefits) Repayments 69

Clergy 50 R Amount previously included in

income 103

P Contributions: Raffles 73 Railroad retirement benefits 62

Retirement savings

Paper vs. electronic contribution credit 22 Railroad retirement Social security benefits 62, 69

return (See E-file) Taxation of 49 benefits 61–65, 74 Unemployment

Paperwork Reduction Act of Decedent's unrecovered Deductions related to 65 compensation 70, 71

1980 3 investment in 13 Employer retirement plans Reporting:

Parental Disability pensions 52 different from 78 Rollovers 82

responsibility (See Children) Elective deferral limitation 49 Equivalent tier 1 (social security Required minimum

Parents, divorced or Employer plans: equivalent benefit distributions 81, 83

separated 28 Benefits from previous (SSEB)) 61, 74 (See also Individual retirement

Parents who never married 29 employer's plan 78 Estimated tax 63 arrangements (IRAs))

Parking fees: Rollover to IRA 82, 88 Form RRB-1042S for nonresident Required minimum distributions

Employer-provided fringe benefit: Situations in which no aliens 61 (RMDs) 75

Exclusion from income 49 coverage 78 Form RRB-1099 61 Rescue squad members:

Partners and partnerships 100 Inherited pensions 74 Joint returns 65 Life insurance proceeds when

Income 68 Military (See Armed Forces) Lump-sum election 63 death in line of duty 68

Passive activity: Unrecovered investment in 103 Married filing separately 22, 63 Reservists:

Losses 23 Withholding 13, 39 Repayment of benefits 62 IRAs 78

Pass-through entities 100 Per capita taxes: Reporting of 63 Repayments 77

Patents: Deductibility of 98 Taxability of 61, 63 Residency:

Infringement damages 72 Personal exemption 36 Withholding 39 Home outside U.S. (See Citizens

Royalties 70 Personal injury suits: Not tax deductible 98 outside U.S.)

Payment of estimated tax 41 Damages from 72 Withholding for 63 Residency test 27

By check or money order 41 Personal property: Railroad Unemployment Resident aliens:

Credit an overpayment 41 Rental income from 69 Insurance Act 53 Estimated tax 40

Payment of tax 3, 9, 15, 18, 42 Personal property taxes: Real estate: IRA distributions, withholding

By credit or debit card 10 Deduction of 98 Canceled business debt, from 84

Delivery services 10 Schedule A, C, E, or F (Form treatment of 67 Social security number (SSN) 12

Estimated tax 15 1040) 98 Division of real estate taxes 95 Spouse treated as 23

Installment Taxes (See Personal property Form 1099-S to report sale Retired Senior Volunteer

agreements (See Installment taxes) proceeds 96 Program 51

agreements) Personal Itemized charges for services not Retirees:

Late payment penalties 19 representatives (See Fiduciarie deductible 97 Armed forces:

Payments 105, 106 s) Real estate-related items not Taxable income 51

Disaster relief 71 Persons with deductible 97 Retirement planning services 49

Payroll deductions 98 disabilities (See Disabilities, Transfer taxes 98 Retirement plans 22, 36, 61

Payroll taxes 47 persons with) Real estate taxes: (See also Roth IRAs)

(See also Social security and Place for filing 16 Assessments (See Local (See also Railroad retirement

Medicare taxes) Political campaign assessments) benefits)

Peace Corps allowances 51 expenses 101, 102 Cooperative Clergy 50

Penalties 41, 43 Political housing (See Cooperative Contributions:

Accuracy-related 19 contributions (See Campaign housing) Credit for (See Retirement

Backup withholding 39 contributions) deduction of 95 savings contribution

Civil penalties 19 Power of attorney 14, 22 Deduction of: credit)

Criminal 20 Premature distributions (See Early List of deductible taxes Taxation of 49

Deductibility 101 withdrawal from deferred interest (Table 11-1) 97 Decedent's unrecovered

Defenses 19 account) Schedule A, C, E, or F (Form investment in 13

Estimated tax (See this heading: Prepaid: 1040) 98 Disability pensions 52

Underpayment of estimated Insurance 55 Refund, treatment of 96 Elective deferral limitation 49

tax) Preparers of tax returns 14 Rebates (See Refunds) Employer plans:

Failure to include social security Presidential Election Campaign Recharacterization: Benefits from previous

number 13, 20 Fund 13 IRA contributions 82 employer's plan 78

Failure to pay tax 19 Price reduced after purchase 67 Recordkeeping: Rollover to IRA 82, 88

Form 8606 not filed for Principal residence (See Home) Gambling 103 Situations in which no

nondeductible IRA Privacy Act and paperwork Savings bonds used for coverage 78

contributions 76, 80 reduction information 3 education 58 Inherited pensions 74

Fraud 19, 20 Private delivery services 10 Recordkeeping requirements 16 IRAs (See Individual retirement

Frivolous tax submission 20 Prizes and awards 46, 74 Basic records 16 arrangements (IRAs))

Interest on 15 (See also Bonuses) Copies of returns 16 Military (See Armed Forces)

IRAs: Exclusion from income 46 Electronic records 16 Withholding 13, 39

Early distributions 85 Pulitzer, Nobel, and similar Gambling 73 Retirement savings contribution

Excess contributions 84 prizes 74 Period of retention 17 credit:

Form 8606 not filed for Scholarship prizes 75 Proof of payments 17 Adjusted gross income limit 22

nondeductible Professional license fees 102 Why keep records 16 Returns, tax (See Tax returns)

contributions 76, 80 Professional Reputation 102 Recovery of amounts previously Rewards 74

Overstatement of Profit-sharing plans: deducted 68 Rhode Island Temporary

nondeductible Withholding 13, 39 Itemized deductions 69 Disability Benefit Fund 95

contributions 80 Property: Mortgage interest refund 68 Rollovers 81

Required distributions, failure Found 73 Over multiple years 69 Definition of 81

to take 83 Stolen 75 Tax refunds 68 Excess due to incorrect rollover

Late filing 10, 19 Public assistance benefits 71 Refunds 105 information 85

Exception 19 Publications (See Tax help) State tax 68 From 403 plan to IRA 81

Publication 17 (2020) Page 133