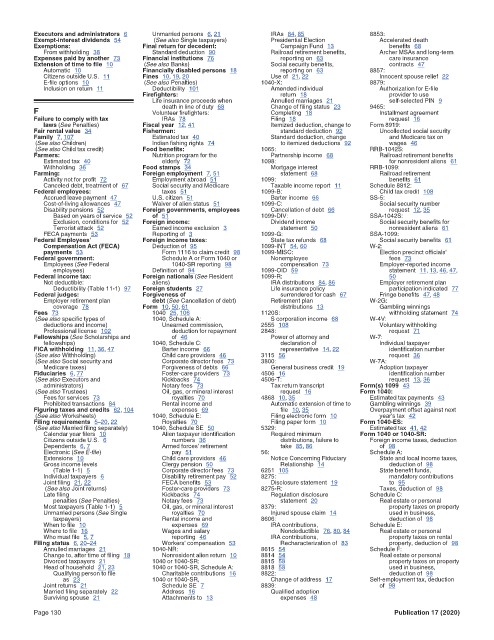

Page 134 - 2020 Publication 17

P. 134

Page 132 of 138 Fileid: … ations/P17/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

8853:

Executors and administrators 6 Unmarried persons 6, 21 IRAs 84, 85 14:38 - 19-Jan-2021

Exempt-interest dividends 54 (See also Single taxpayers) Presidential Election Accelerated death

Exemptions: Final return for decedent: Campaign Fund 13 benefits 68

From withholding 38 Standard deduction 90 Railroad retirement benefits, Archer MSAs and long-term

Expenses paid by another 73 Financial institutions 76 reporting on 63 care insurance

Extension of time to file 10 (See also Banks) Social security benefits, contracts 47

Automatic 10 Financially disabled persons 18 reporting on 63 8857:

Citizens outside U.S. 11 Fines 10, 19, 20 Use of 21, 22 Innocent spouse relief 22

E-file options 10 (See also Penalties) 1040-X: 8879:

Inclusion on return 11 Deductibility 101 Amended individual Authorization for E-file

Firefighters: return 18 provider to use

Life insurance proceeds when Annulled marriages 21 self-selected PIN 9

death in line of duty 68

F Volunteer firefighters: Change of filing status 23 9465:

Completing 18

Installment agreement

Failure to comply with tax IRAs 78 Filing 18 request 16

laws (See Penalties) Fiscal year 12, 41 Itemized deduction, change to Form 8919:

Fair rental value 34 Fishermen: standard deduction 92 Uncollected social security

Family 7, 107 Estimated tax 40 Standard deduction, change and Medicare tax on

(See also Children) Indian fishing rights 74 to itemized deductions 92 wages 46

(See also Child tax credit) Food benefits: 1065: RRB-1042S:

Farmers: Nutrition program for the Partnership income 68 Railroad retirement benefits

Estimated tax 40 elderly 72 1098: for nonresident aliens 61

Withholding 36 Food stamps 34 Mortgage interest RRB-1099:

Farming: Foreign employment 7, 51 statement 68 Railroad retirement

Activity not for profit 72 Employment abroad 51 1099: benefits 61

Canceled debt, treatment of 67 Social security and Medicare Taxable income report 11 Schedule 8812:

Federal employees: taxes 51 1099-B: Child tax credit 108

Accrued leave payment 47 U.S. citizen 51 Barter income 66 SS-5:

Cost-of-living allowances 47 Waiver of alien status 51 1099-C: Social security number

Disability pensions 52 Foreign governments, employees Cancellation of debt 66 request 12, 35

Based on years of service 52 of 51 1099-DIV: SSA-1042S:

Exclusion, conditions for 52 Foreign income: Dividend income Social security benefits for

Terrorist attack 52 Earned income exclusion 3 statement 50 nonresident aliens 61

FECA payments 53 Reporting of 3 1099-G: SSA-1099:

Federal Employees' Foreign income taxes: State tax refunds 68 Social security benefits 61

Compensation Act (FECA) Deduction of 95 1099-INT 54, 60 W-2:

payments 53 Form 1116 to claim credit 98 1099-MISC: Election precinct officials'

Federal government: Schedule A or Form 1040 or Nonemployee fees 73

Employees (See Federal 1040-SR reporting 98 compensation 73 Employer-reported income

employees) Definition of 94 1099-OID 59 statement 11, 13, 46, 47,

Federal income tax: Foreign nationals (See Resident 1099-R: 50

Not deductible: aliens) IRA distributions 84, 86 Employer retirement plan

Deductibility (Table 11-1) 97 Foreign students 27 Life insurance policy participation indicated 77

Federal judges: Forgiveness of surrendered for cash 67 Fringe benefits 47, 48

Employer retirement plan debt (See Cancellation of debt) Retirement plan W-2G:

coverage 78 Form 10, 50, 61 distributions 13 Gambling winnings

Fees 73 1040 25, 106 1120S: withholding statement 74

(See also specific types of 1040, Schedule A: S corporation income 68 W-4V:

deductions and income) Unearned commission, 2555 108 Voluntary withholding

Professional license 102 deduction for repayment 2848: request 71

Fellowships (See Scholarships and of 46 Power of attorney and W-7:

fellowships) 1040, Schedule C: declaration of Individual taxpayer

FICA withholding 11, 36, 47 Barter income 66 representative 14, 22 identification number

(See also Withholding) Child care providers 46 3115 56 request 36

(See also Social security and Corporate director fees 73 3800: W-7A:

Medicare taxes) Forgiveness of debts 66 General business credit 19 Adoption taxpayer

Fiduciaries 6, 77 Foster-care providers 73 4506 16 identification number

(See also Executors and Kickbacks 74 4506-T: request 13, 36

administrators) Notary fees 73 Tax return transcript Form(s) 1099 43

(See also Trustees) Oil, gas, or mineral interest request 16 Form 1040:

Fees for services 73 royalties 70 4868 10, 35 Estimated tax payments 43

Prohibited transactions 84 Rental income and Automatic extension of time to Gambling winnings 39

Figuring taxes and credits 62, 104 expenses 69 file 10, 35 Overpayment offset against next

(See also Worksheets) 1040, Schedule E: Filing electronic form 10 year's tax 42

Filing requirements 5–20, 22 Royalties 70 Filing paper form 10 Form 1040-ES:

(See also Married filing separately) 1040, Schedule SE 50 5329: Estimated tax 41, 42

Calendar year filers 10 Alien taxpayer identification Required minimum Form 1040 or 1040-SR:

Citizens outside U.S. 6 numbers 36 distributions, failure to Foreign income taxes, deduction

Dependents 6, 7 Armed forces' retirement take 85, 86 of 98

Electronic (See E-file) pay 51 56: Schedule A:

Extensions 10 Child care providers 46 Notice Concerning Fiduciary State and local income taxes,

Gross income levels Clergy pension 50 Relationship 14 deduction of 98

(Table 1-1) 5 Corporate director fees 73 6251 105 State benefit funds,

Individual taxpayers 6 Disability retirement pay 52 8275: mandatory contributions

Joint filing 21, 22 FECA benefits 53 Disclosure statement 19 to 95

(See also Joint returns) Foster-care providers 73 8275-R: Taxes, deduction of 98

Late filing Kickbacks 74 Regulation disclosure Schedule C:

penalties (See Penalties) Notary fees 73 statement 20 Real estate or personal

Most taxpayers (Table 1-1) 5 Oil, gas, or mineral interest 8379: property taxes on property

Unmarried persons (See Single royalties 70 Injured spouse claim 14 used in business,

taxpayers) Rental income and 8606: deduction of 98

When to file 10 expenses 69 IRA contributions, Schedule E:

Where to file 16 Wages and salary Nondeductible 76, 80, 84 Real estate or personal

Who must file 5, 7 reporting 46 IRA contributions, property taxes on rental

Filing status 6, 20–24 Workers' compensation 53 Recharacterization of 83 property, deduction of 98

Annulled marriages 21 1040-NR: 8615 54 Schedule F:

Change to, after time of filing 18 Nonresident alien return 10 8814 54 Real estate or personal

Divorced taxpayers 21 1040 or 1040-SR: 8815 58 property taxes on property

Head of household 21, 23 1040 or 1040-SR, Schedule A: 8818 58 used in business,

Qualifying person to file Charitable contributions 16 8822: deduction of 98

as 23 1040 or 1040-SR, Change of address 17 Self-employment tax, deduction

Joint returns 21 Schedule SE 7 8839: of 98

Married filing separately 22 Address 16 Qualified adoption

Surviving spouse 21 Attachments to 13 expenses 48

Page 130 Publication 17 (2020)